IQ Option Deposit

IQ Option is one of the most popular and versatile broker platforms with a wide array of trading instruments. Additionally, the platform allows users to create a free demo account to practice their trades and get acquainted with the interface.

However, if you’re planning on trading with real money, it is essential to have secure and smooth ways of depositing your money. IQ Option makes depositing money into your trading account hassle-free while providing numerous ways to go through with the process.

Deposit Options

IQ Option provides traders with various user-friendly deposit methods. Listed below are the methods that can be used to deposit money in your IQ Option account:

#1. Credit Cards And Debit Cards

By using a credit or debit card, users can deposit money into their trading account in an instant. Additionally, there is no need to create an extra account since most traders already own a bank card. What’s more, the deposit is processed immediately, and the funds are directly added to the IQ Option trading account.

An added benefit of using bank cards is the transparency of the transactions. Meaning, using a bank card will not provoke any hidden charges or fees. This feature allows traders to make multiple deposits to their IQ Option account without being charged for every transaction.

Currently, the cards supported by the IQ Option platform are Visa, Visa Electron, MasterCard, and Maestro.

#2. Bank transfer

A bank transfer is essentially an electronic transfer of money from one bank to another before it reaches the beneficiary’s account. This method is suitable for users who don’t have an e-wallet or a bank card.

A bank transfer is one of the most reliable ways to deposit your money into your IQ Option account due to the security it offers. Banks require identity verification, a physical address, and other information of anyone opening a bank account.

However, due to the extra security, this method has a long processing time, and it can take up to 3 days for the money to reflect in your IQ Option account.

#3. E-Wallets

E-wallets are digital wallets that have become increasingly popular these days. They are often used to pay for products or services purchased online. Moreover, these wallets allow users to make instantaneous and secure transactions conveniently and smoothly.

A majority of e-wallets are accepted on the IQ Option platform, and using them has never been easier. In addition, using an e-wallet to deposit money into your IQ Option account has no hidden costs or extra fees.

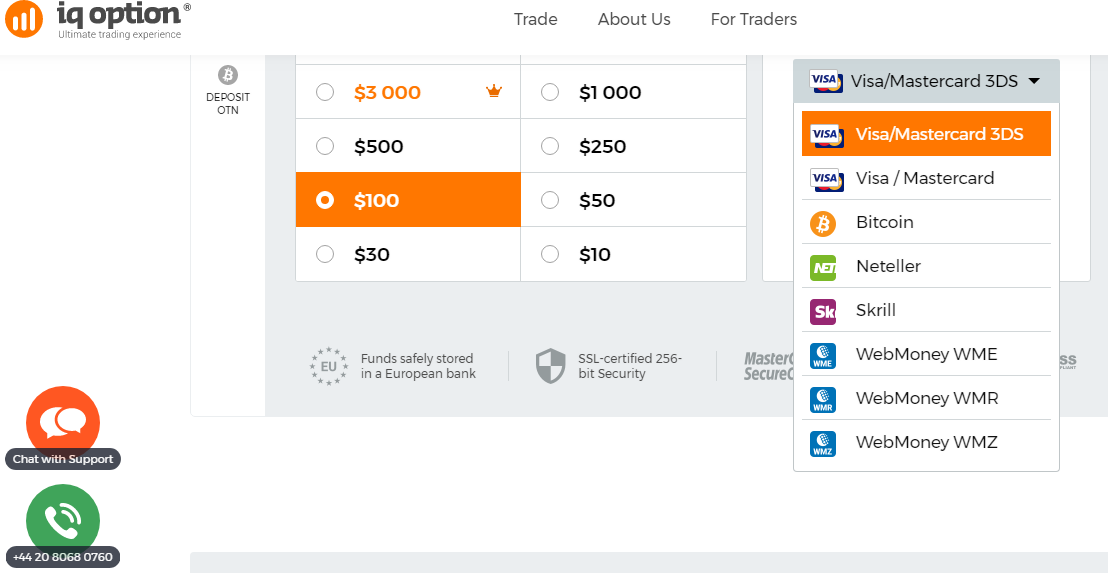

The available e-wallets include WebMoney, Skrill, Neteller, AdvCash, and many more. Most of these wallets require password verification before proceeding with a transaction. Consequently, a few e-wallets permit the user to make small transactions without verification.

#4. Bitcoin

Bitcoin has been recently added to the growing list of IQ Option deposit methods. It is a form of digital “currency” which is rapidly gaining popularity. This method is a convenient way to add funds to your account if you already own the required Bitcoin.

Note: The funds added to your account will be credited in the currency of your account in fiat money.

Furthermore, the first deposit made to the platform has to be an alternative payment method other than Bitcoin. Transactions can take up to 30 minutes to receive a confirmation, and failed payments are refunded within 24 hours.

How To Deposit Money In IQ Option South Africa (Step By Step Guide)

Adding funds to your IQ Option account from South Africa is extremely easy. IQ Option offers users various methods to deposit funds to their accounts.

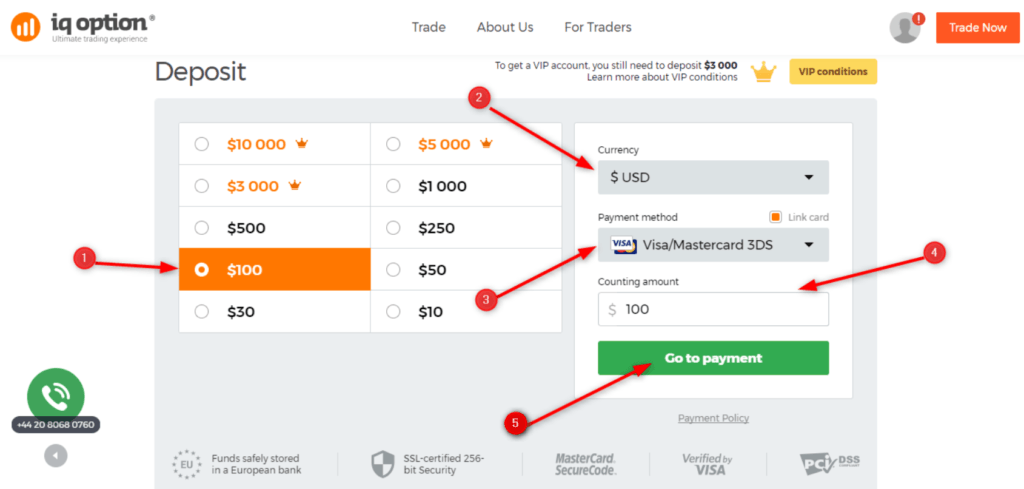

To add funds to your account, users will be required to log in and head to the “My Account” tab in the top left corner of the screen. The list of available deposit options will appear by choosing the “Deposit” option from the drop-down menu.

Let’s take a look at the different methods and steps involved in depositing funds to your IQ Option account.

1. Deposit Funds Using A Bank Card

The funds are added instantly and will reflect in your IQ Option account.

2. Deposit Using E-Wallets

3. Deposit Using Bitcoin

Note: It may take up to 30 minutes for the transaction to be verified and confirmed.

To summarize, users in South Africa can use the methods mentioned above to deposit funds to their IQ Option account effortlessly and securely.

Deposit Limitations (Minimum and Maximum)

When it comes to online brokers, a minimum amount of funds have to be deposited into your account to get you started. While the minimum deposit varies from broker to broker, it is determined by certain factors.

Factors such as minimum trade size, the trading account’s base currency, and broker preferences determine the minimum deposit for the broker.

Luckily, on IQ Option, the minimum trade size is only $1. This allows IQ Option to have a low minimum deposit of only $10. However, the U.S. dollar isn’t the only currency available. Depending on your nationality, users can get a choice of at least 3 different base currencies for their account.

Apart from the USD and EUR, the other currencies offered by IQ Option are:

- Malaysian Ringgit

- Chinese Yuan

- Indonesian Rupiah

- Vietnamese Dong

- Thai Baht

- Russian Ruble

IQ Option enables many users to trade and deposit with their local currency. And in most instances, the minimum deposit for IQ Option is around $10 when converted from other currencies. Consequently, the minimum deposit amount for traders using the IQ Option VIP account is $1900.

The maximum deposit for IQ Option is $20,000, but this amount can vary for certain assets depending on the market conditions.

Deposit Fees

Unlike other online brokers, IQ Option does not take any fees from traders when depositing funds to their accounts. Users can add money to their account multiple times without being charged for any transaction by IQ Option.

Nonetheless, it is important to be aware of transaction fees charged by the bank for making international deposits.

How to Check Deposit Status?

Most of the methods offered by IQ Option to add funds to your account are speedy, and the transactions are verified and approved in an instant. Although, in certain cases like a bank transfer, it may take some time to validate your deposit request.

Users will receive a ticket after making a deposit. These tickets are then processed and credited to the IQ Option account within two working days. If your deposit hasn’t been approved within two business days, you can contact the support team at IQ Option and have your issue resolved quickly.

Promo Bonus

IQ Option does not offer a sign-up bonus for newcomers or beginner traders. This is due to the promotions ban laid out by its regulatory body Cypress Securities and Exchange Commission (CySEC).

Common Problems

IQ Option strives to offer its users convenient ways of depositing funds to their accounts. Though the process of depositing funds is straightforward, there are certain instances where users can face a problem.

Any issues with depositing funds can be resolved by checking the information entered correctly. Here are a few common problems and tips to fix them quickly:

- If you have a problem depositing with your bank card on your mobile device, use the computer to complete the transaction, and it should work like a charm.

- Deposits may be declined if users enter the wrong 3-D secure code at the time of the transaction. Enter the correct code to proceed or contact your bank if you didn’t receive a 3-D code.

- Certain deposits may be declined due to the bank restricting international payments. It is advisable to contact your bank and check for this information.

FAQ

IQ Option is a legitimate online broker and is one of the most distinguished companies in this field. With over 50,000,000 registered users, they are also the most successful binary options broker in the industry.

To top it off, IQ Option is governed and licensed by the CySEC (Cyprus Securities and Exchange Commission) and the FSA (Seychelles Financial Services Authority). The company is also a member of the Investors Compensation Scheme, which is known to protect client funds up to $20,000.

Even better, IQ Option has won multiple awards for its reliability and quality of service over the years. Rest assured, IQ Option is one of the safest places to put your money.

Yes. Users are required to verify their identity to deposit funds. The account verification process ensures no fraudulent activity takes place via the account.

To verify your account, users have to submit a photo of their ID, such as a passport or driver’s license. If you are depositing funds using a bank card, you will be requested to upload a photo of the card to IQ Option. Remember to cover the CVV and show only the first six and last four digits of the card.

You cannot change the currency of your real account. The base currency will be fixed the first time you make a deposit. For example, anyone depositing US dollars will have the base currency of their account set to USD.

The first deposit plays an important role in deciding the currency of your account. Once you have completed the deposit, it is not possible to change the currency of your account. This still allows users to make a deposit in any currency. But, IQ Option will automatically convert it to the currency of your account.

The waiting period for the funds to reflect in your IQ Option account depends on the method used to deposit the funds. IQ Option brings convenience to the fingertips of its users when it comes to depositing money.

Payments made using bank cards and electronic payment systems like Skrill, Advcash, WebMoney, and GlobePay are instantly processed. Moreover, the funds will reflect in your IQ Option account as soon as the transaction is completed.

For other e-wallets, it can take anywhere between 1-60 minutes for the transaction to process and the funds to reflect in your account. Similarly, for bank transfers, the processing time is 1-3 business days, and the funds will reflect in your account once the transaction has been verified.

Yes. IQ Option supports payments made via UPI. Users who don’t have an international bank card or are having difficulties setting up an e-wallet can add funds to their IQ Option account via electronic payment applications like AdvCash.

Verdict

IQ Option makes depositing money to your account a fast and hassle-free experience. Now you’re aware of all the payment modes supported by IQ Option to deposit money. While they have their pros and cons, users must select the option best suited for them.

Furthermore, it is extremely safe to deposit money in IQ Option, and there are no hidden charges when adding funds to your trading account. What are you waiting for? Join IQ Option now and hop on to the binary options bandwagon.