Olymp Trade Withdrawal (Common Problems and Questions)

Confused about how you can withdraw your money? Or if you can cancel your withdrawal?

Or maybe, you want to know how long before the withdrawal reflects in your bank account?

Whatever your questions or problems with withdrawals on Olymp Trade, you are in the right place.

This detailed guide answers all questions, provide solutions to common problems, and is a stepwise guide to withdrawals for a seamless experience.

But before we jump into the process, here's a small summary

We have done a complete review on Olymp Trade for South African traders to ensure that all the process executed in Olymp Trade is safe and genuine.

If you are trading from India, Beyond2015.org has a great review of the Olymp Trade platform for Indian traders.

How to Withdraw Your Money on Olymp Trade?

Follow these steps, and you will be able to withdraw your money on Olymp Trade into your bank quickly and easily:

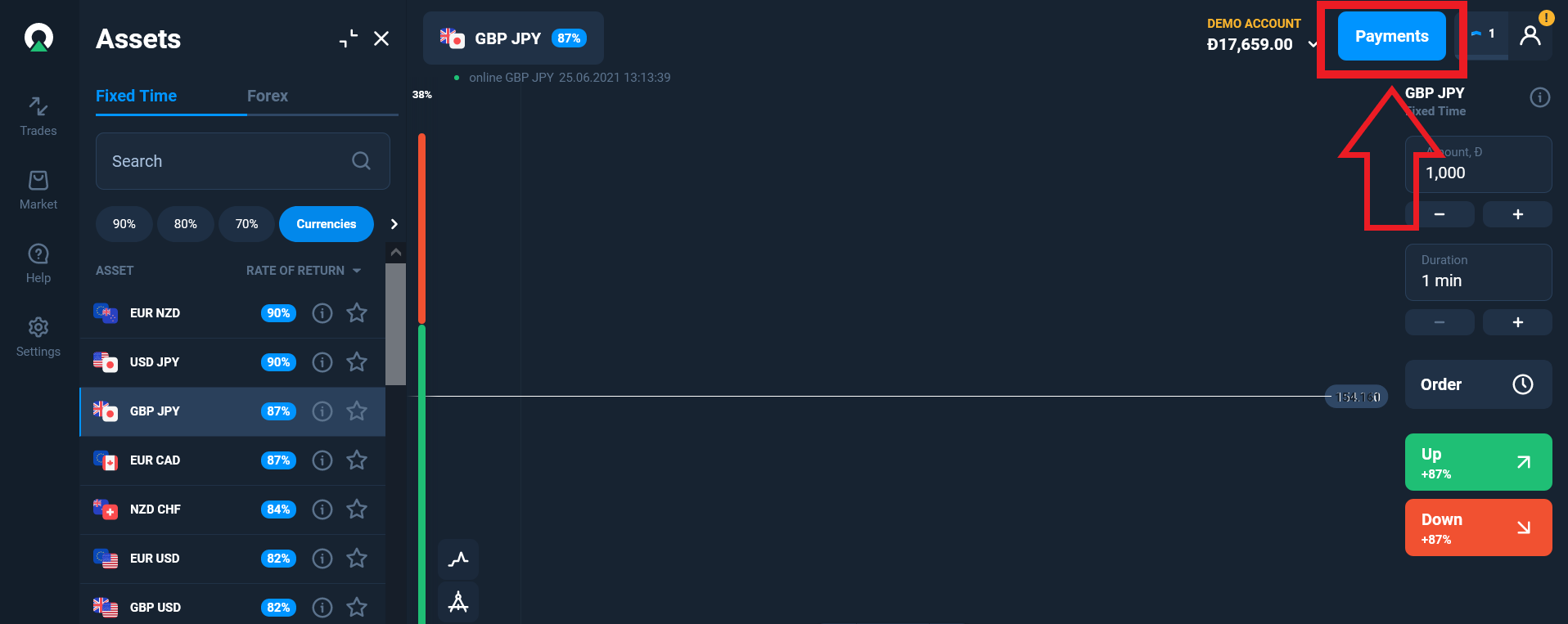

Step 1: On the platform page that you see when you log in, click on the Payments option you see on the upper right corner of the screen.

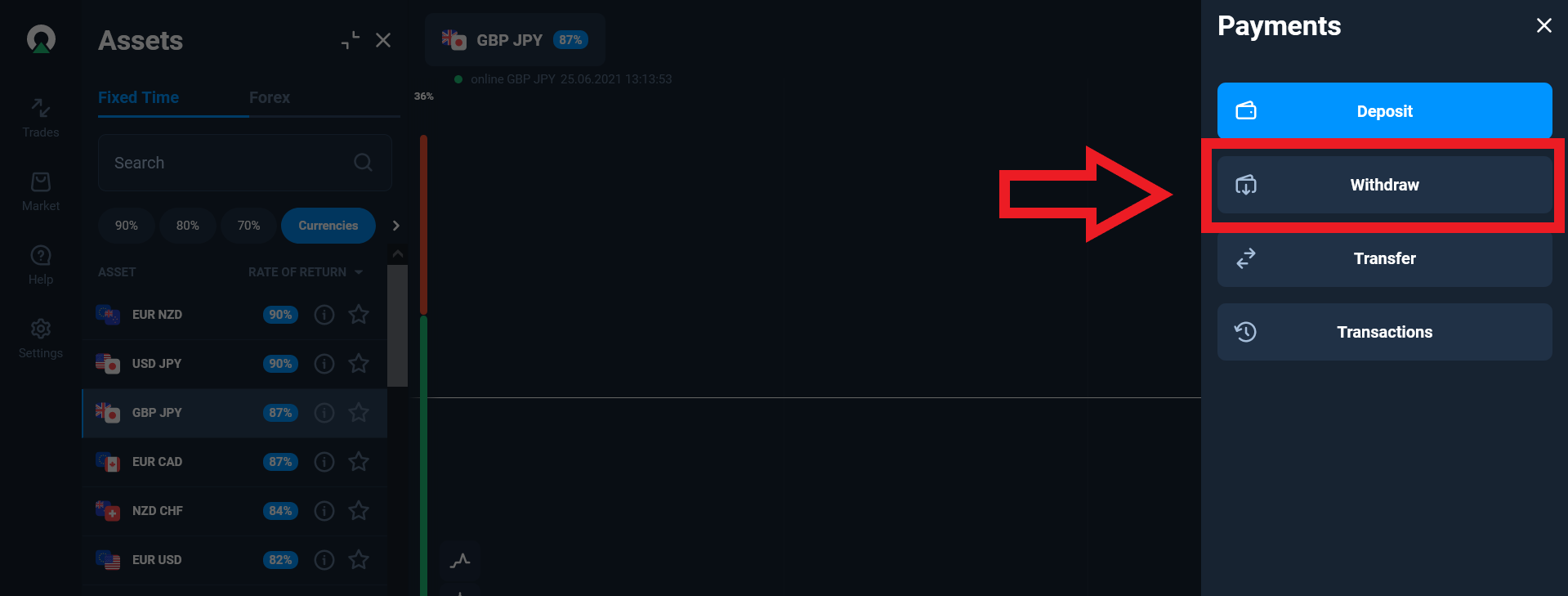

Step 2: Next, click on Withdrawal. This opens up the Withdrawal page.

Step 3: Pick the payment method of your preference.

Step 4: Enter the amount you want to withdraw. Your total account balance is also available on the left-hand side, so you know precisely how much to withdraw.

Step 5: Next up, hit the Send a Request button in blue, and voila, you should have your profits in your account within days.

Note: If you use the Olymp Trade App for withdrawal, the process remains pretty the same and is equally quick.

Withdrawal Methods Available on Olymp Trade

Here's a list of the withdrawal methods you can use on Olymp Trade

- Bank Cards

- Electronic Payment System

- Virtual Bank Cards

- Cryptocurrencies

- Net Banking

- UPI

FYI, make sure you have used these methods to make deposits as well before withdrawing.

Does Olymp Trade Charge Withdrawal Fee?

Withdrawals on Olymp are 100% free, which means they do not charge any commission. The platform covers all costs.

However, your bank or wallet could be charging a withdrawal or deposit fee. So if you have received less money than you thought, get in touch with them about it.

How Long Does a Withdrawal Take?

According to Olymp Trade, processing withdrawals, in general, takes 5 days or less. However, 90% of the requests are processed within 24 to 48 hrs.

However, there are a few things you can do to ensure a quick-fire withdrawal

Proof - Is Olymp Trade Really Paying?

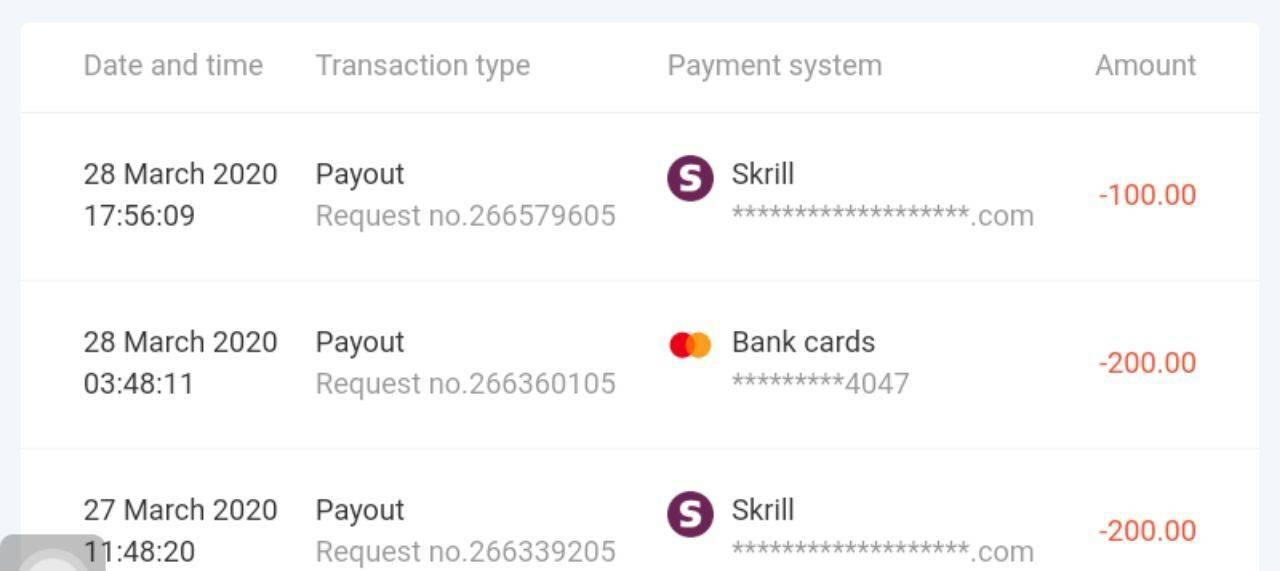

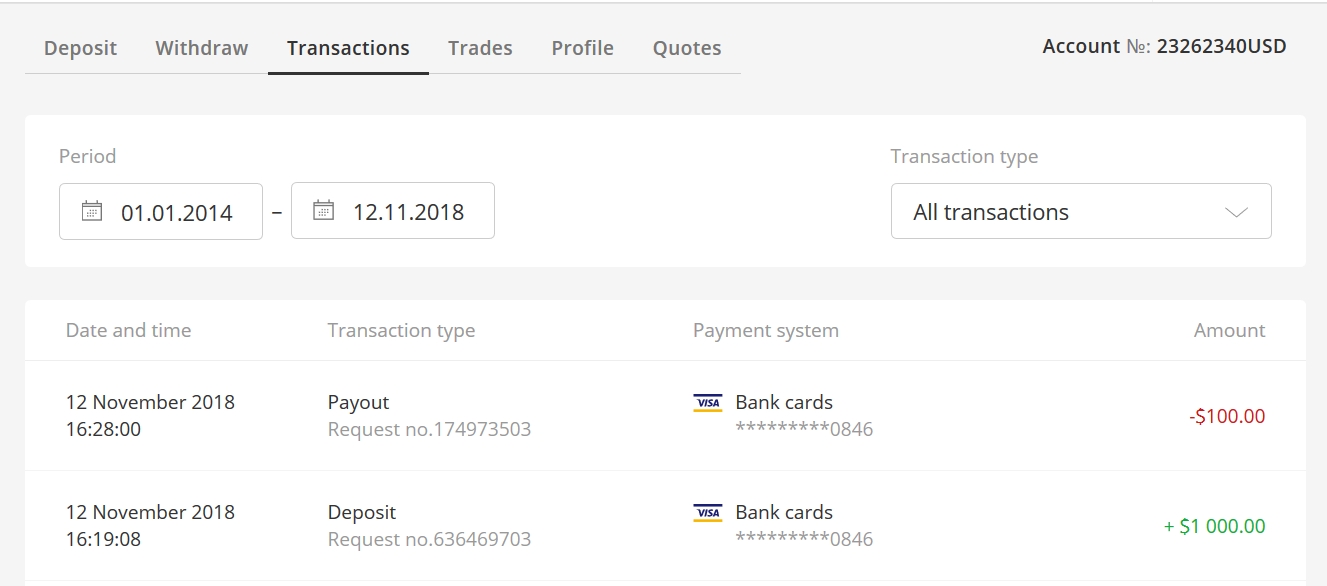

Worried your profits may never reach your bank? Let's put those fears to bed with some withdrawal proofs.

Withdrawals Limits on Olymp Trade

Below is a list of the minimum withdrawal amount based on the various payment methods available on Olymp Trade.

Payment Method | Minimum Withdrawal Amount |

|---|---|

Bank cards (Visa/Mastercard, JCB, China UnionPay) | $10 |

Skrill | $10 |

Neteller | $10 |

WebMoney | $10 |

Net banking | $10 |

UPI | $10 |

AstroPay Card | $10 |

GlobePay | $10 |

Perfect Money | $10 |

FasaPay | $10 |

Jeton | $10 |

Bitcoin | $100 |

Ethereum | $250 |

Tether | $100 |

Also, your bank or wallet might have daily transaction limits on them. In this case, the payment is divided into parts automatically.

Lastly, you cannot make multiple withdrawal requests together. You'll have to wait for the previous request to be processed first.

How to cancel a withdrawal request on Olymp Trade?

Had a change of heart after submitting the withdrawal request? No problem, you can always cancel a request as it usually takes a few hours to process them. Here's how it is done.

Click on the Transactions option available on the user menu located on the top of the platform page,

Here you'll see a list of deposits and withdrawals made.

If the request hasn't been processed yet, you'll see the option to cancel it.

In case you lose some money, and the amount requested for withdrawal is higher than the balance in your account, the request is canceled automatically.

Common Problems Traders Face with Withdrawal

In case you haven't received your withdrawal even after 5 days and it shows you processed successfully on Olymp Trade, you'll have to get in touch with the bank for further details as the issue lies on their end.

Banks do not provide Olymp Trade with a reason for the decline. In most cases, the payments get declined because the user has crossed their deposit and withdrawal limit for the day. It can also be because you transferred the amount to a blocked card or wallet. Contact your bank/ wallet support team for help with this.

The only thing Olymp Trade can do for you is, send the payment to your preferred wallet or bank card.

If the card or wallet you used for deposits gets blocked, you can make withdrawals using a payment mode you haven't used for making deposits. Keep in mind that such requests are personally approved by the financial manager and thus can take some time to process.

To get in touch with them, you can use the online chat or call them at +27 (21) 1003880 Cape Town, South Africa. You can also email your queries but keep in mind that replies can take about 24-hrs

You need to complete your KYC for withdrawal because it helps in Olymp Trade prevent fraud and ensure the payment reaches the right person asap. If any documents are required, Olymp Trade will email you instructions on how to upload/send them. Do not send documents unless asked for.

You cannot withdraw the whole amount at once into your bank/wallet because your bank or wallet has capped the amount that can be transferred to you in a day. Don't worry. Your withdrawal request has been processed, and payments will automatically come in as per the limits until the requested amount hits your account.

Yes, you can withdraw deposits into different accounts only if you have used both methods to make deposits. For example, suppose you put $10 from your Mastercard and $50 from Neteller. In that case, the withdrawal amount should be proportional to the deposits from each method. If you want to withdraw just your profits, you can do so without any such restrictions.

Yes, you can check withdrawal status, but you'll need ARN or Acquirer's Reference Number for it. This comes in handy when the withdrawal process is delayed.

To remove payment methods, you'll have to verify your account and get in touch with the support team. They'll let you know if removal is possible or what you need to do about it.

Bonuses are provided by Olymp Trade and cannot be withdrawn. You can only used it trading after you meet the minimum deposit requirements. If you submit a withdrawal request right after receiving a bonus, the bonus amount is canceled.

Final Thoughts

There's everything you need to know for quick and easy withdrawals on Olymp Trade. The first transaction can be a bit bumpy with all the verification that goes into it, but after that, it is plain sailing.

Also, the verification or KYC is in place for your safety as it ensures the money reaches the right person.

Use Skrill, Neteller, or bank cards for quicker withdrawals. Make sure you reach expert statuses as quickly as possible (because the withdrawals become almost instant).

If you just came across Olymp Trade and are worried your lack of expertise will empty your pockets, no problem. Sign up and start with the $10,000 demo account, and don't forget to check out all the training videos to better understand both Olymp Trade and Trading.

And for any questions related to withdrawals on Olymp Trade, let me know in the comments section below or via the contact page.