IQ Option Withdrawal

Withdrawing money from IQ Option is a speedy and straightforward process. IQ Option offers its users a variety of methods to withdraw money. It is just a simple process, verify your account, and you can start withdrawing your funds immediately.

Although the steps to withdraw funds are mostly the same for most broker companies, there can also be vital differences. These consist of small factors like the maximum amount you can withdraw and the time duration for the money to reflect in your bank account.

What puts IQ Option on the top of the charts is the streamlined process. And this makes it an attractive platform for seasoned and beginner trainers. Let's take a deep look at the IQ Option withdrawal process and everything related to it.

We have done a detailed review on IQ Option Check out the article here, IQ Option Review – Is it a Scam? [South Africa, 2022]

Withdrawal Options Available on IQ Option

IQ Option provides its users with multiple convenient options to withdraw their funds. While processing all withdrawals is done within one day, other factors can help you pick a withdrawal method.

IQ Option offers its services worldwide, and traders have the freedom to choose a payment option that is popular in their region.

Let's check out the various methods of withdrawal below:

- Credit Card and Debit Card

One of the easiest ways to withdraw funds from IQ Option is via credit or debit card. Currently, the broker supports withdrawal requests from bank cards such as Visa, Maestro, MasterCard, and Visa Electron.

Still, if you have second thoughts about withdrawing, you can rely on easy knowing IQ Option. It exhibits a merchant-level payment card industry-level and data security standard. - Wire Transfer

Wire transfer is another method of withdrawal offered by IQ Option. However, this method is not popular among users due to its prolonged waiting time. First, the withdrawal request is verified within 24 hours on IQ Option. Then, once the request leaves IQ Option, it can take up to 3 working days for your bank to process the request.

In addition, depending on your bank and location, you may get charged a fee for making the transaction. Most users can avoid this fee by simply using a bank card or another withdrawal method like an e-wallet. - E-Wallets

E-wallets are rapidly gaining popularity in the 21st century. They bring the convenience of a bank card to your fingertips and have transformed how we look at micro-transactions. Apart from making payments to other vendors, an e-wallet permits its users to receive money as well.

In other words, you can use an e-wallet that is supported by IQ Option to make a withdrawal from your account. Consequently, these digital wallets are run by a third-party provider. Therefore, choosing the popular ones will ensure you don't face any unwanted issues.

Neteller, Skrill, and WebMoney are a few e-wallets that work seamlessly with IQ Option.

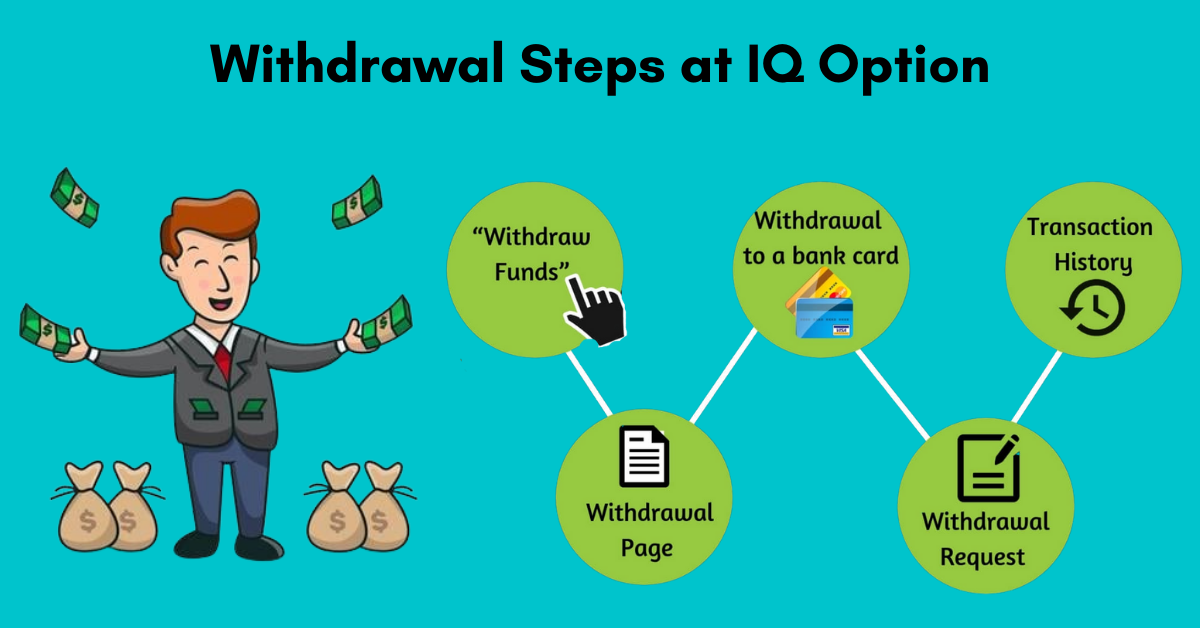

How to Withdraw Your Money on IQ Option?

Users can initiate the withdrawal process from their IQ Option account either from the homepage or the trade room. While there are multiple methods to withdraw money, the process is almost the same across all options. Let's look at the steps involved in making a withdrawal request in IQ Option.

- Traders can initiate the withdrawal process either from the homepage or the trader room.

- On the homepage, click on the "Withdraw Funds" option from the menu on the right side of the screen. It will lead you to the IQ Option withdrawal page.

- Similarly, if you're in the trade room, click on your user icon and select "Withdraw Funds" from the drop-down menu.

- Choose the most appropriate one for you from the list of available payment methods.

You will be required to specify payment details. These will vary depending on the option you picked. To further illustrate, a wire transfer withdrawal will need your ID details. In contrast, an e-wallet such as Skrill will request your phone number.

After that, you can specify the withdrawal amount and complete your transaction.

IQ Option: Withdrawal Limitations (Minimum and Maximum)

To withdraw funds using a bank card, traders must use the same bank card that made the deposit at IQ Option. It's because IQ Option processes a bank card withdrawal as a refund. Moreover, the withdrawal amount cannot go beyond the total deposit made for ninety days. Therefore, the withdrawal amount should be equal to or less than the deposit. However, this does not apply to e-wallets.

What's more, be sure to verify your account with your e-wallet service provider and ensure your virtual card is eligible for a refund. Taking these precautions will guarantee users don't face any complications when withdrawing from IQ Option.

With the newly implemented card processing system - IQ Option can instantly verify withdrawals made using a bank card. Nevertheless, once the request has been approved, it can take your bank up to 9 days to credit the funds to your bank account.

Moreover, traders who have used Bitcoin to deposit funds will need to choose an e-wallet or a bank transfer to withdraw funds from their IQ Option account.

Note: Making a mistake in the billing information will cancel your withdrawal request at IQ Option.

Withdrawal Fees

IQ Option allows users to withdraw their profits once a month without commission. However, they charge a 2% fee for each withdrawal once the free withdrawal has been redeemed. Although these commissions may seem like a lot, they are capped at $25 and will not exceed the limit.

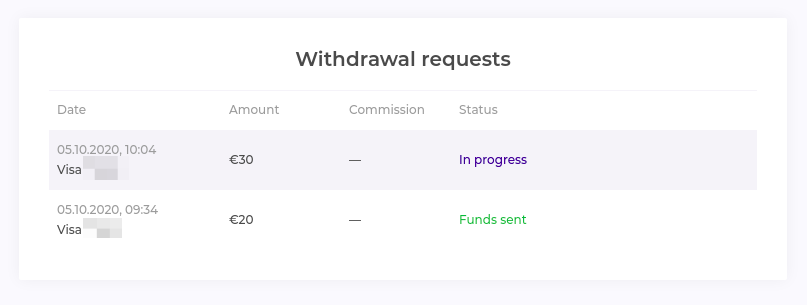

How To Check Withdrawal Status?

IQ Option allows users to check the real-time status of their withdrawals. To do so, head to the withdrawals page and look for the status indicator. Four indicators inform users about their withdrawals. These are:

- Requested: The withdrawal request is in progress.

- Hold: The user will need to verify existing documents or provide additional documents.

- Funds Sent: The withdrawal request has been processed successfully.

- Canceled: The operation has failed.

Verification Before Withdrawals at IQ Option

While a phone number and email verification are enough to deposit IQ Option, users will have to complete the verification process to withdraw funds. It includes verifying your identity and payment method.

- ID Verification

You can upload your ID by going to the "verification" page from the homepage of IQ Option. You can also confirm your email and phone number from this tab if you haven't done so already.

To ensure no fraudulent activities occur on the platform, IQ Option requests the users' ID. The broker accepts any legal identity document such as a passport or driver's license. Additionally, the document must be visible, with no signs of damage, cropping, editing, watermarks, or drawings.

Furthermore, it must include your full name, date of birth, photo, expiry date, number, and signature. Having these documents in order will ensure you get past the verification process in a breeze.

- Bank Card Verification

The final step in verifying your identity is to prove your ownership of the bank card used for transactions on IQ Option. It must be issued in your name.

Proceed by taking a photo of both sides of the card. Moreover, to prevent security issues, cover all sensitive data like the CVV code and six digits of the card number before uploading the scan to IQ Option.

Once all your documents have been submitted, they will go through a moderation process. It may take up to 3 business days. Keep in mind; traders will be eligible to request their first withdrawal once the documents are approved.

- Processing Time

What makes IQ Option popular among traders is the lightning-fast processing time. Although withdrawal requests are processed and sent to the payment system provider within 24 hours, the total transaction time solely depends on the payment method.

Usually, bank cards are the preferred payment method due to instant transactions. However, depending on the banking service provider, it may take around 21 days to process the payment.

Though most e-wallet transactions are processed immediately, it can take anywhere between 1-3 business days for completion. On the other hand, a wire transfer through a bank will take around three working days to get processed and verified.

Do I Need To Provide Any Documents To Make A Withdrawal?

Yes, your IQ Option account needs to be verified if you plan on making a withdrawal. If users want to verify the account, they will be required to prove their identity by submitting their passport or driver's license. Consequently, the bank card linked to the transaction also needs to be verified before making a withdrawal.

Apart from this, the phone number and email id also need to be verified by the IQ Option team.

FAQ's

Although IQ Option processes the transactions immediately, they can take time to get verified on the service providers' network. The transaction time varies depending on the method of payment. It can range from 21 days for a bank card to 1 day for an e-wallet transaction or eight days for a local bank transfer.

The Withdrawal Time Is Up, And My Funds Are Not Yet Credited?

While this is not a common occurrence, certain users have experienced this issue. If you're in this situation, you can resolve this by simply checking your account. In addition, you must count only the working days since transactions aren't processed over weekends or holidays.

Remember to verify your account and upload all the necessary documents. Moreover, ensure you have entered the correct bank account credentials and e-wallet address. Finally, keep in mind the withdrawal fee when you add the withdrawal amount.

If you have checked all the boxes and the problem persists, simply get in touch with the helpful folks in the IQ Option support team. They will readily lend a helping hand via live chat, email, or phone.

Usually, the reasons for rejection are mentioned on the verification page. But, if you're still unsure whether your documents are valid, you can check the requirements stated on the verification page and the FAQ section on the IQ Option website.

The most common reasons for rejection are as follows:

- The document was blurry or had watermarks on it.

- The document you submitted is expired.

- You have submitted the wrong document.

- The document doesn't belong to you.

Verdict

Making a withdrawal through IQ Option is as easy as earning money using their app. With multiple methods for users to choose from, IQ Option has transformed how society looks at online brokers. The platform strives to bring convenience to the users' fingertips while staying transparent and providing the best for the user.

Above all, there are no hidden fees for credit card and e-wallet transactions. Traders only need to consider fees when making a wire transfer. What's better, IQ Option also processes withdrawal requests within twenty-four hours and for free!

With such lucrative deals, who wouldn't be tempted to join IQ Option? Hurry up and register to start trading in various financial assets this broker offers.