Olymp Trade Review - Is it a Scam? [South Africa, 2024]

Category Winners

Why we recommend Olymp Trade in South Africa:

Not a Fraud

Recommended

Free $10,000 credit for demo account

Is Olymp Trade a scam? Are they regulated by any legit organization? Can I use Olymp Trade in South Africa?

If you too have these questions about Olymp Trade before you sign up, we are glad you found this blog.

I’ll not just answer those questions above. From partnerships, awards, licenses to a detailed overview of the trading platform and its tools, this is your one-stop guide for everything Olymp Trade.

What is Olymp Trade?

Olymp Trade is an online broker that supports both Forex and Fixed-Time trading.

It is owned by a company named Saledo Global LLC registered at First Floor, First St. Vincent Bank Ltd Building, P.O. Box 1574, James Street, Kingstown, St. Vincent & the Grenadines.

Furthermore, it has been in operation since 2014, and that alone should instill trust in any user. After all, can a scam continue for 6-7 years without being noticed?

That too, considering they currently have 25+ million users and 8+ million in monthly payouts (quite impressive, isn’t it?).

But wait, that’s not all. Here are some other notable facts and figures about Olymp Trade:

And whether you are a newbie or an experienced trader, its intuitive interface coupled with video tutorials means you can learn to use it within a day or two.

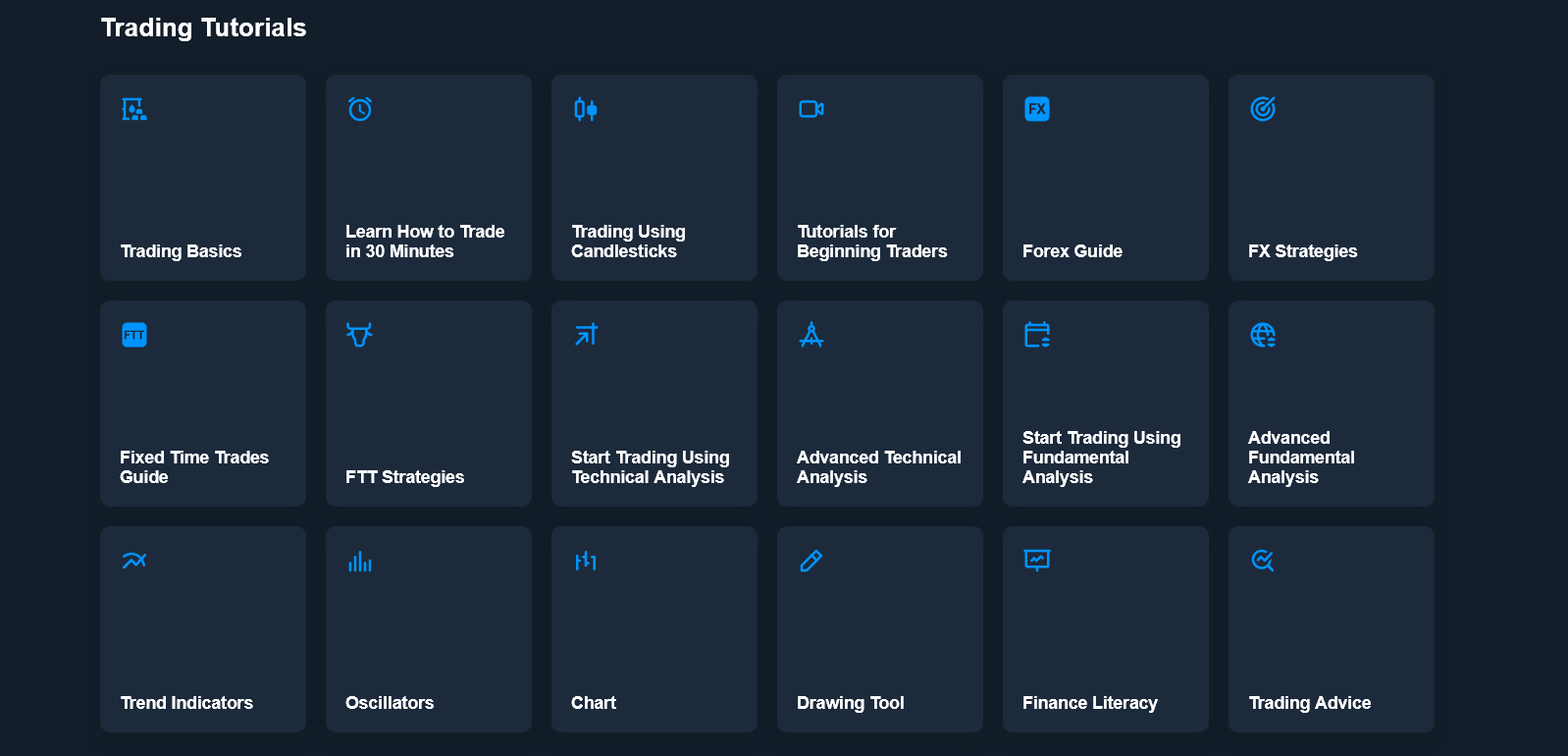

We aren’t just talking about tutorials to understand their features but trading in general. Don’t believe us? Here’s a glimpse of what you’ll find on their Help Center Page.

NOT

SCAM

Is Olymp Trade a Scam?

Olymp Trade is not a scam. Trading via Olymp Trade and similar platforms is legal in South Africa as there are no laws against it.

And to judge whether the platform is a scam or not, there were 5 main questions I wanted answers to.

Here’s what I found:

Regulations: Finacom (International Financial Commission)

2 years into its operation, Olymp Trade became a member of Finacom in 2016. So what is Finacom? What guarantees do they give you? Can they also be trusted?

But before we dig into that, you can check out Olymp Trade’s Finacom certificate here.[1]

The Financial Commission is a self-regulatory organization created specifically to handle disputes related to Forex and solve them in the fastest possible manner while remaining unbiased and authentic.

But those are just words, is there any guarantee, promise?

Absolutely. Suppose a member fails to adhere to the judgment of the authority in case of a dispute. In that case, the commission guarantees to give a compensation of €20,000 per case within 90 days.

24*7 Customer Care

A real business never leaves its customers in the dark or abandons them when they have queries. The quicker the help comes, the better, right? And that’s just what you get with Olymp Trade.

You can get in touch with their support team via chat and phone call. To start the chat, just click on Help on the left-hand side menu.

Click on Support

Click on Open Chat. If you want to make a call, this window shows the helpline number and email. You can also access the knowledgebase for video tutorials

Enter the name and email and start the chat.

You can also get in touch via phone call though it may take a tad longer as you have to navigate past the various options. The number for Cape Town, South Africa is 27 (21) 1003880.

Either way, their support staff was cordial and happy to answer as many questions as I had with quick replies. And at the end of the call or chat, you can rate the experience and leave comments as well.

While that may not mean much, it shows the company cares about your opinion and experience.

You can also get in touch via email but expect a reply within 1 business day. It is slower but not a problem if the issue isn’t serious and you don’t want to make a phone call.

Awards:

If Olymp Trade is legit and as efficient, quick as they say, then someone must be recognizing their efforts and work, correct? Well, here’s the list of awards Olymp Trade has won in just 6 years:

Partners

If your business is booming and helping people, everyone would love to partner with you. So checking out the list of partners was my next criteria.

FinFalcon manages Olymp Trade’s advertisement, and on their webpage, you can see Olymp Trade has partnered with over 200+ companies.

Some of these companies include Mobivista, Mobio, ClickDealer, and Taptica. Apart from these, they also have strategic financial partners in place.

For example, PayPal, Visa, MasterCard, Skrill, etc., ensuring withdrawals or deposits, the process remains seamless for you.

In 2019, Olymp Trade also became the official sponsor of the LCR Honda MotoGP™ Team.

But you don’t always have to be a big company with 100+ employees to partner with them. Even bloggers and influencers can partner with them via Olymp Trade’s affiliate program.

Social Media Activity

Any legit company will have a social media presence (I mean who doesn’t these days, right?). And I am not talking about some ghosted profile with no likes or comments.

If Olymp Trade claims it is as big and popular as it is, surely its social media should be bustling with comments, likes, followers, etc.

Well, I wasn’t disappointed, and neither will be you. They have 1M+ likes and followers on their Facebook page. They regularly post content and get a decent amount of likes, shares, and comments.

Their YouTube channel, where they post guides on using their platform, trading tips, courses, etc., has 200,000+ followers with a healthy amount of views, comments, and likes.

Twitter has only about 20K followers. Not as high as Facebook but nothing that raises a red flag for me.

Accepted Countries

Countries Olymp Trade is blocked/banned in include Canada, Australia, United States, Japan, Austria, Belgium, Bulgaria, Cyprus, Denmark, Finland, France, Germany, Ireland, Italy, Israel, Latvia, Lithuania, Netherlands, Norway, New Zealand, Portugal, Poland, Romania, Slovakia, El Salvador, Spain, Switzerland, Sweden, United Kingdom, Russian Federation.

However, you can use Olymp Trade via your smartphone, laptop, or desktop if you live in Thailand, South Africa, Singapore, Hong Kong, India, United Arab Emirates, Saudi Arabia, Kuwait, Luxembourg, Qatar.

To make navigation, understanding the platform, and trading easier for its users in all of these countries, Olymp Trade is available in 19 different languages, including English (UK), Spanish, Filipino, Hindi, and so on.

As per PRNewswire, Olymp Trade further added 3 more North African countries to the mix in September 2020.

Understanding the Trading Platform Better

Assets

Unlike some of the other traders on the block, Olymp Trade isn’t limited by the types of assets available. There’s also no binding on what you can trade, and neither do you have to create multiple accounts for trading.

From Currencies, Crypto, Commodities, Metals, Stocks, to even Indices, OTC, and ETFs, you can trade anything and everything you possess knowledge about.

And to help you make these trades with a profit, Olymp Trade has plenty of tools, charts, etc., that help you forecast the prices. Here’s a little more on them.

Olymp Trade Charts

To help you better understand the trend, Olymp Trade has 4 charts. These are Area, Bars, Heiken Ashi, and the most popular Japanese Candlesticks.

What makes Japanese Candlesticks so popular is that they display price ups and downs in a specific period. The Candlesticks are green if the price is going up and red if the price is going down.

Similar to Japanese Candlesticks are bars except much thinner. These are helpful in case you find the Candlesticks too cluttered.

The Heiken Ashi chart also looks similar as they are also colored green and red but aren’t as popular as the Candlesticks chart. That’s because it is not based on pure prices (OHLC), but calculations made using prices.

On the other hand, the line chart is linear, which shows you the price movements.

Olymp Trade Tools (And How Each Helps You)

Insights

This is one of my favorite tools on Olymp Trade as it gives me forecasts and a short review of various assets like stock, currency, etc.

For example, it may say something like Gold might sustain momentum or Procter & Gamble Stock May Provide A Stable Dividend growth.

It takes just a click to use it and is available on the platform page.

Advisors

This is like your assistant on Olymp Trade that tracks the behavior of assets you commonly trade and advises you on the ideal entry and exit point based on your previous trades.

These tools are great if you are a semi-pro or pro, but what if you are a complete newbie? Well, time to call in the experts.

Personal Analyst

Olymp Trade also gives you the option to get in touch with a personal analyst who’ll tell you about the platform features and give you trading secrets. They’ll even give you one-on-one training.

This option is available on the platform page when you click Help. Though keep in mind, only users with an advanced or expert account status have access to this.

Trading Signals

The trading signal does exactly as the name suggests. It gives you forecasts on whether an asset’s price is bound to rise or reduce in the next few hours.

With starter and advanced accounts, you only get basic signals. In contrast, you get both basic and private trading signals (and these can be real game-changers).

Analytics Page

Not exactly a tool, but just as helpful. The Olymp Trade Analytics Page[2] gives you all the latest news from the trading world and technical analysis, market overviews, and forecasts. I find the page pretty useful at the start of my day and takes just 5-6 minutes to go through.

Oh, and it is free and does not need you to upgrade your account to access it (even non-members can view it).

How to Register on Olymp Trade?

To register on Olymp Trade, visit the official Olymptrade website and start the sign up process. You can do it via your mobile, tablet, or desktop/laptop. On either of those devices, creating an account takes less than 5-minutes. In some ways, like with Gmail, it only needs 2-3 steps.

Apart from Gmail, you can use other emails or your Facebook and AppleID.

You can also create an account on Metatrader 5 and log in to Olymp Trade using that. To know how to create an account on MetaTrader, check out this guide.

Accounts on Olymp Trade

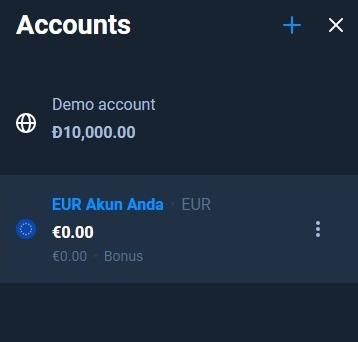

After you create your account, you can choose between a Real Account or Demo Account.

Demo Account

A demo account is a no-risk, no-profit account where you get $10,000 to practice. Use this to test out your trading skills and learn the platform.

And once you trust your abilities, time to make some real money with a Real Account that is just one click away.

Real Account

With a real account, there’s more to Olymp Trade than just making profits. For every trade, you also get experience points or XP.

Creating Multiple Accounts on Olymp Trade

Yes, you can have 5 interconnected accounts on Olymp Trade with different currencies such as Euro, Dollar, or a local currency based on your location.

You can use these accounts to try out different strategies and store your profits.

Deposits

Olymp Trade gives you the freedom to choose pretty much any payment method. That includes not just your Mastercard and Visa cards but also Net Banking, wallets, and Crypto.

I prefer Skrill and Neteller as deposits with them are safer and quicker. The bank might stop payments if they aren’t sure of the source. The minimum deposit to get started is $10.

You can learn how to make deposits via these methods and get bonuses here: Olymp Trade Deposits (Common Problems and Questions)

Withdrawals

Withdrawals are only allowed on methods you used for depositing money. They are also just as easy as deposits (if not easier) and require no more than 3-4 clicks. Plus, there’s no limit on how much profit you can withdraw.

Suppose you are wondering how long a withdrawal can take or how to do it seamlessly. In that case, we cover the steps and answers to common questions in this detailed withdrawal guide: Olymp Trade Withdrawal (Common Problems and Questions)

Account Status

You start with the starter status and can go up to Expert status. With an expert status, you earn higher profits and get benefits like a risk-free trade, almost instant withdrawals, etc.

To upgrade and maintain your status, you need to earn XP. And you can learn how to get more XP on our Olymp Trade Statuses & Trader's Way Guide.

If you don't want to wait to earn those XP and ready to pay some bucks to instantly access the benefits of Advanced and Expert status, read our article on Olymp Trade Market and Platform Extensions: Common Questions and Problems.

The Olymp Trade App

You can also use the Olymp Trade app to register and make trades from anywhere and everywhere. The app is just 18MB and thus barely takes up memory or space. It has a 4.1 star rating with 50M+ downloads.

Also, it gives you all the features you’d find on the desktop version and works with both Android and iOS devices.

Here’s how to download and install the app (link internally to app article) and other details about it.

Final Verdict on Olymp Trade

Olymp Trade would hands down be my #1 pick, if I had to choose a platform for Forex or fixed time trading. It has been in business for over 10 years and is also regulated by Fincom.

Plus, their app has over 50 million downloads and over 600,000 reviews, with a rating of 4.1 stars.

And further adding to the trust is their reliable and efficient 24*7 customer care that you can connect to within minutes using phone or chat.

It is an excellent platform for both newbies and professional traders. There are tools and services to help everyone, such as charts, personal analysts, trading signals for forecasts, etc.

But most of all, I love the demo account that ensures you only enter the battlefield fully armed and loaded (and aren’t taking shots in the dark).

Oh, and if you create your account now, they are even giving away a 50% bonus on a deposit of $500 or more. So if you do not want to miss out on some free money and have the funds to invest, what are you waiting for?

But don’t forget, any kind of trading is risky, and if you don’t make the right moves, you will lose money. So play safe.

Category Winners

Verdict

Olymp Trade is the best choice for both novice and experienced traders, it is also our best recommended broker.

Free $10,000 credit for demo account

FAQs

Yes, but only if you play your cards right. With Olymp Trade Expert accounts, you can earn up to 92% profit, and you only need to invest a mere $1. Even with regular accounts, profit margins are around 80%.

Yes, Olymp Trade is available for users in South Africa since there’s no law specifically calling it illegal. The International Finance Commission regulates Olymp Trade. People in South Africa get access to a full range of their tools and services.

Olymp Trade doesn’t block accounts unless there’s a strong reason like using another person’s account to transfer funds, using Olymp Trade from an unsupported country, etc. In case your account is blocked, get in touch with customer care to have the issue resolved.

Check out our article for the reasons of a blocked account and how to get it unblocked: Olymp Trade Blocked Accounts and How to Unblock Them

A risk-free trade means that if you lose the amount you invest as your estimation was wrong, it is returned to your account. Use it to make some big moves on the platform.