Olymp Trade Strategy

Olymp Trade (OT) is an online trading platform for amateur and professional investors and traders across the globe. Established in 2014, the platform has marketed itself in 194 countries in these seven years. Currently, it has a subscriber base of 60 million accounts among different parts of the world, including Brazil, South Africa, Britain, etc.

With a monthly number of transactions of 30 million, Olymp Trade is available in 13 different languages like English, French, Arabic, etc. The monthly average payouts and the monthly trade turnover on the platform are 16 million and 211 million US dollars. Also, though trading through Olymp Trade is restricted in countries like Iraq, Sweden, Denmark, etc., it is 100% legal and safe in South Africa.

So, being a South African trader, you can always make money on Olymp Trade, and that too by complying with all legalities.

In our article Olymp Trade Review, we have covered basic topics about Olymp Trade like deposits, withdrawals, verification etc., but to make sure you become a good trader, you need to learn some tricks and strategies which are mentioned below:

Olymp Trade Strategy

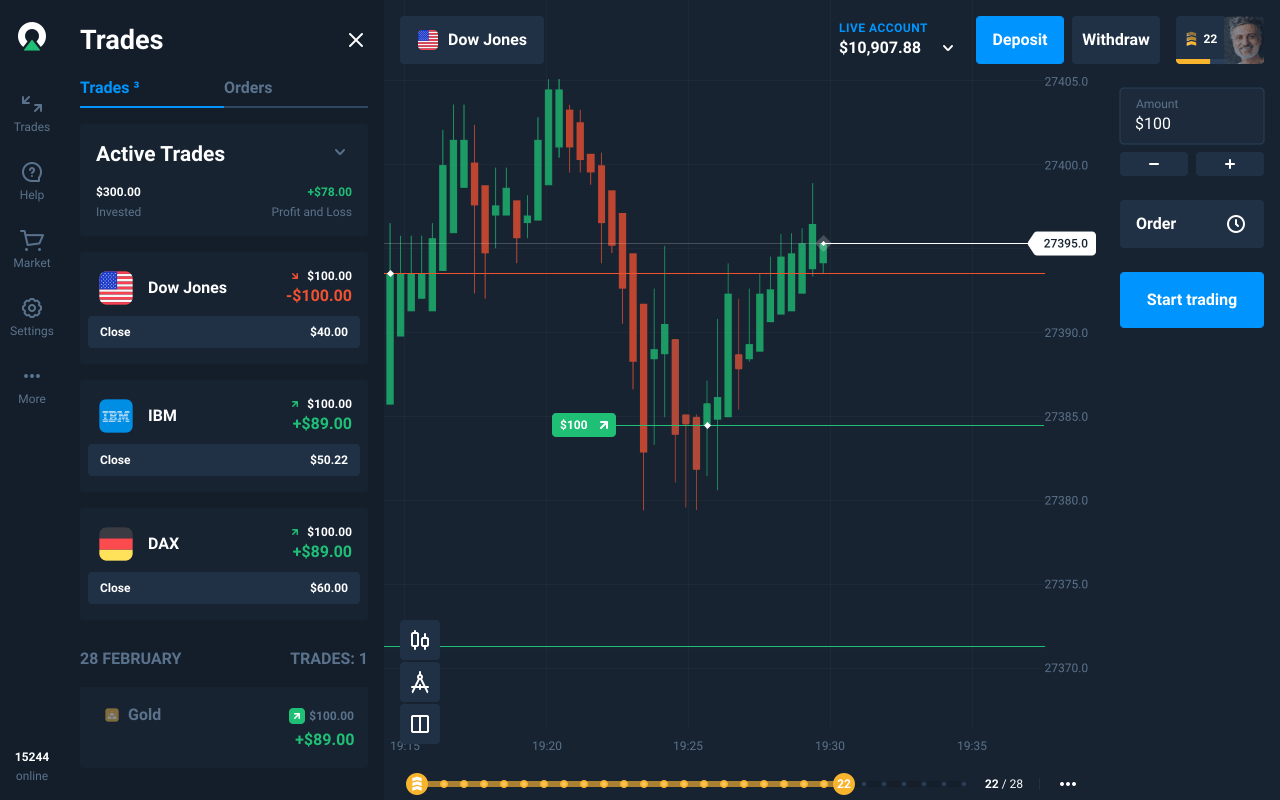

By knowing the correct trading skills and strategies, any individual can increase their success rate and make more profit. Olymp Trade provides its users with two main kinds of trading: Fixed Time Trading and Forex Trading. Understanding these terms and then implementing strategies unique to both is the key to acing the trading business.

#1. Fixed Time Trading Strategies

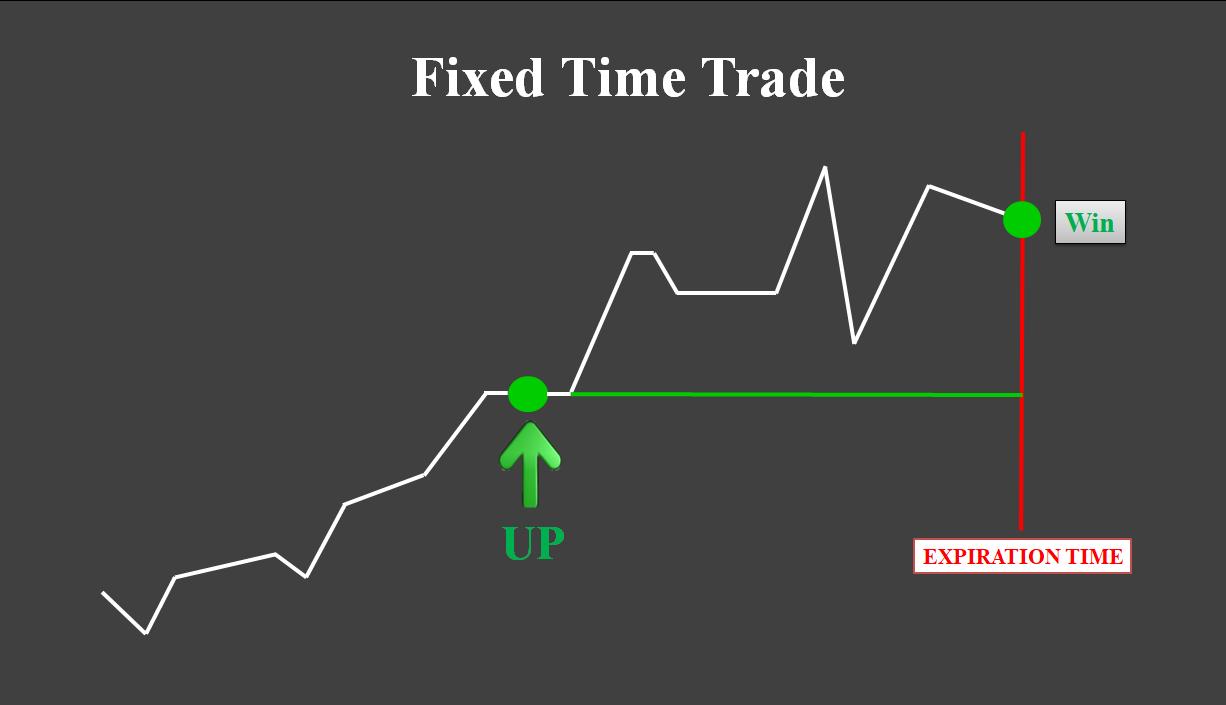

There's a prediction required within a limited time frame in fixed-time trading, i.e., whether the price of an asset will increase or decrease. This is also why it falls under the binary options definition because it needs a prediction before the timeframe expires. On correct prediction, the trader receives his initial investments with a bonus. But, on failing to do so, the trader will lose his initial investments.

In other types of trading, profits and losses are variable. However, in fixed time trading, the potential outcomes are known before completing the trade because the bonus is stated upfront. Contrary to what people believe, Fixed Time Trading is not gambling. Simply by applying statistical analysis and fact-based research, traders can see the results for themselves.

#2. Pick A Market

There is a range of markets from stocks to cryptocurrencies where fixed time trading can be applied. Also, to reduce the risk, you should trade in markets of forex, indices, commodities, etc. However, you can only predict the trade's outcome in any market you choose and not own any asset.

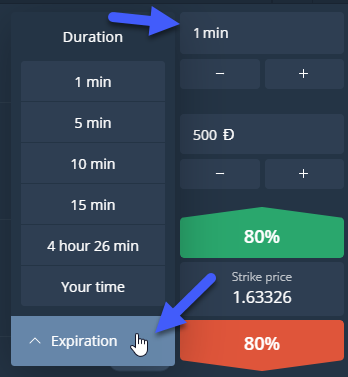

#3. Selecting Expiry Time

In fixed time trading, expiry time ranges from minutes to a few hours. Although, some brokers do occasionally offer more extended periods of trading. In long-term fixed time trading, trade outcomes are likely to be influenced by news related to economic and individual company performance.

Whereas, in short-term trading, sometimes prices can become highly volatile and hard to predict. Therefore, one should avoid short-term trading based on news announcements.

#4. Choosing Right Investment Level

You must brainstorm and strategize your investment level based on your overall capital and wisely thought-out stop-loss and cashout limits. However, the general rule on a single trade is not to risk more than 1 percent of your capital.

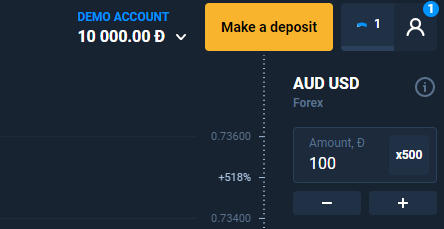

#5. Make Use Of Demo Accounts

Demo accounts can prove exceptionally useful during fixed time trading. Many users use such accounts to practice and learn the platform's features before trading with real money. These accounts use virtual funds to help build the experience needed for actual trading. Furthermore, they fuel the trader with the required knowledge of the user interface and trading environment.

Along with all these, try to implement different technical indicators for further in-depth analysis, one of which is the Directional Movement Indicator (DMI). Many traders prefer this technical tool as it indicates the strength and probability of a continuing trend, and suggests what market factors (technicals) can potentially divert the trend from its predicted path.

#6. Forex Trading

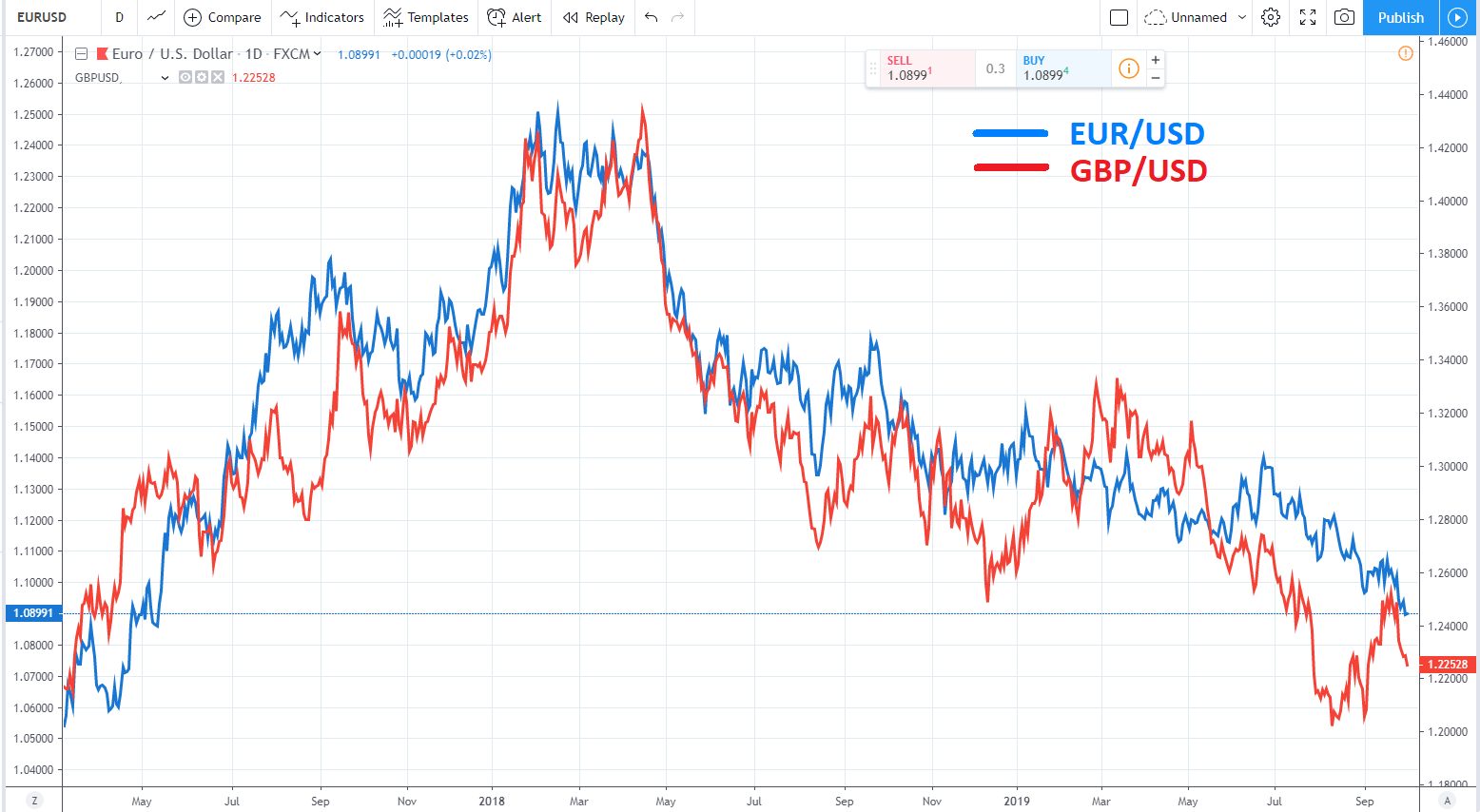

Trading of one currency for another is known as foreign exchange (forex or FX). Basically, forex trade is nothing but when you trade foreign currencies, and the forex market is the place for foreign exchange transactions—for example, swapping US dollars with Euros. Due to the trillions of dollars changing hands every day, this market has become one of the largest liquid markets.

Unlike fixed time trading, this market has no central location, enabling you to trade for 24 hours. In forex trading, strategies can be based on three factors, namely technical analysis, fundamental, or news-based events. However, until one becomes a master of this trading type, forex trading on Olymp Trade also provides demo accounts for you to learn and gather experience.

Whether you are using a demo account or dealing with a real one, a few solid strategies will undoubtedly guide you in increasing your earnings.

#7. Selecting the Market

Before starting any trade, you must clear your vision by selecting the right market as per your timetable, trading goals, and investment capital. In easier words, a trader must determine what currency pairs they trade and focus on becoming experts at reading those currency pairs.

#8. Position Sizing

Position sizing is the number of units an investor or trader invested in a particular security. When determining position sizing, the investor should also consider his account's size and risk tolerance. To work out accurate position sizing and gain maximum profits, the investor needs to divide account risk by the trade risk.

For example, if the trade risk is 20 dollars, and the account risk is 500 dollars, dividing 500 by 20 will give you 25. Thus, 25 is the number of shares that can be purchased.

#9. Determining Entry Points

In trading, entry points are defined as the price at which an investor initiates a position in a security. A trade entry can be initiated with either a buy order for a long position or a sell order for a short position. You predetermine the trading strategy by deciding an entry point beforehand, which helps minimize investment risk and remove emotion-based decision-making from trading decisions.

#10. Always Match Risk Management With Trading Style

When the risk and reward ratio doesn't seem suitable, the trader should begin changing their trading strategies. This will help a trader gain profit and prepare and plan for a fast-changing market. Although, changing forex trading strategy too often can be costly, and you might lose out.

#11. Build Comprehending Strategies

If you are a trader and don't understand complex strategies, steer clear from them. If an uncalculated factor in a strategy shows up or a trader doesn't know the rules, then the strategy's effectiveness gets lost. Therefore, build a strategy that you can comprehend, even if it's a simple one.

#12. Determining Exit Points

Unlike the entry point, exit points in trading are the prices at which an investor closes the position. Traders must develop rules which indicate when to exit a long or short position. This proves especially valuable when deciding the period to exit a loss-making position.

Depending on the direction where the price went after the purchase, the exit point could result in profit or loss. Thus, exit points can be used to manage the risk of loss and set new profit targets.

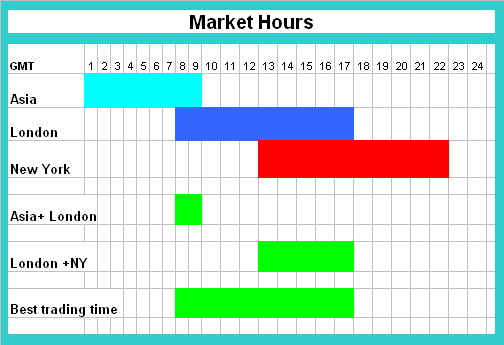

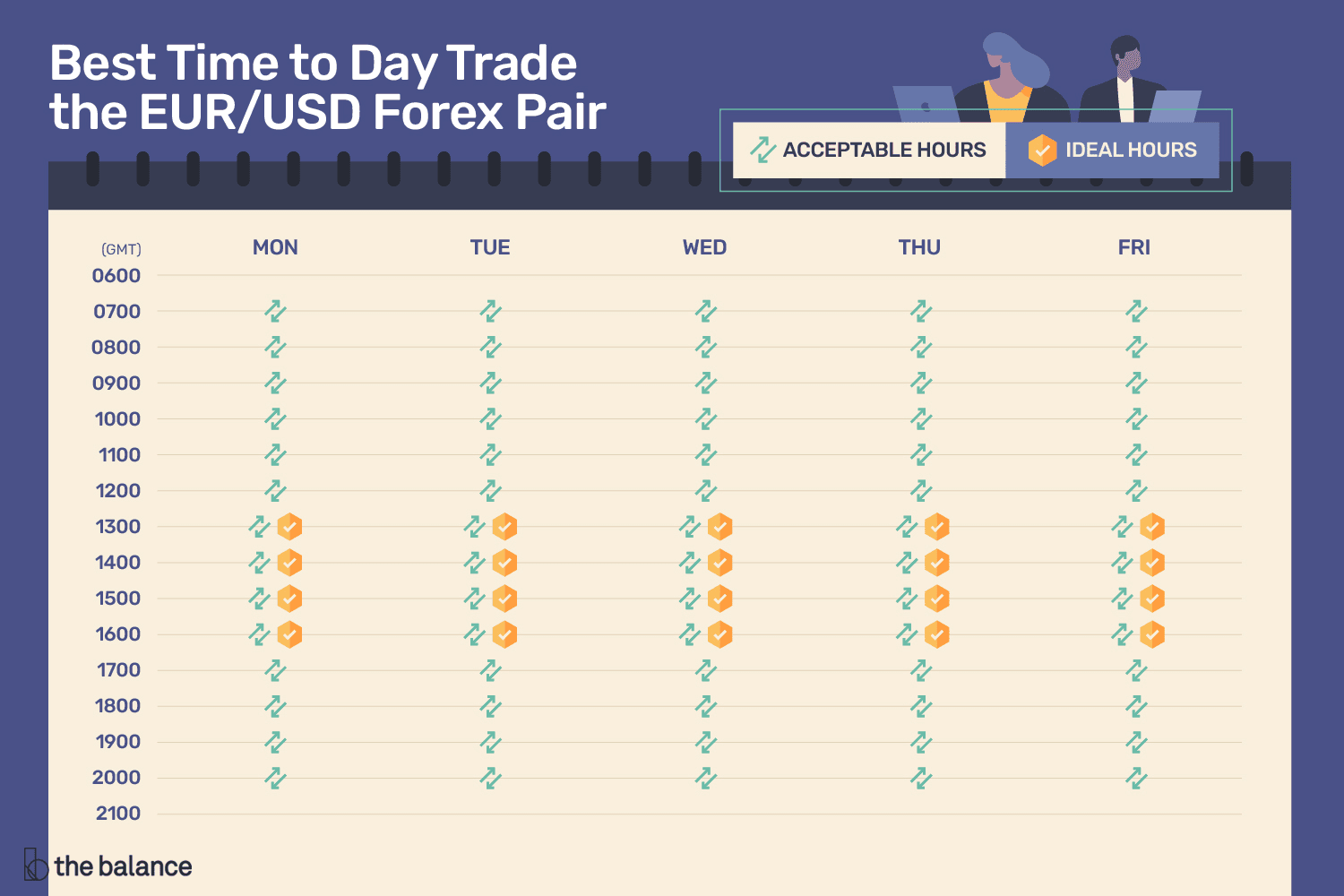

Best Time To Trade on Olymp Trade

Time plays a crucial role, even if it's a trading business. On Olymp Trade, the trader needs to choose the time in conjunction with a currency pair when trading currency pairs. This is because the trading hours of currency markets vary in different time zones.

The currency pair as a financial instrument is always made of two currencies, and every currency is connected to their country’s economy. So, you can expect higher volatility when the financial market in a country is fluctuating. Remember, there are four main time zones, namely, Sydney, Tokyo, London, and New York, to trade.

Now, depending on your preferred time of the day, these are the timings you might choose to trade.

Currency Pairs As Per Preferred Times

If you feel trading in the early morning hours (5 am to 12 pm) is convenient, you might want to look at currency pairs like NZD/USD, EUR/JPY, GBP/USD, USD/JPY, USD/CHF, and USD/CAD.

If you like working in the afternoon period (12 pm to 7 pm), then pairs like EUR/JPY, USD/JPY, USD/CHF, USD/CAD, GBP/USD, GBP/JPY, EUR/USD, and EUR/GBP might be of your interest.

If you like trading at night (7 pm to 5 am), then currency pairs like AUD/USD, EUR/JPY, NZD/USD, USD/JPY, USD/CHF, USD/CAD, GBP/USD, GBP/JPY, EUR/USD and EUR/GBP suit your boat.

Among all these currency pairs, some are of high volatility, some average volatility, and some of the lowest volatility. You as a trader should choose the right time and correct currency pairs for your desired result and maximum profit. Although, a general rule of thumb is that you should aim for trading between 12.00 GMT to 19.00 GMT.

Can Olymp Trade (OT) Make You Rich?

Olymp Trade (OT) is like any other online trading platform, except that it has a range of features to support a variety of traders on their journey. So, it highly depends upon your efforts and diligence whether you will be rich using Olymp Trade or not. Although, contrary to what amateur traders think, online trading is not just about luck and random guesses.

There are steps like performing technical analysis of markets, understanding your position in the market, and having knowledge of the popular terms and strategies that help make money through this platform.

#1. How To Always Win?

Your trading results are influenced by a lot of economic and market-centric factors. Remember, online trading is a business in which no one can guarantee you a 100% win all the time. But, with proper guidance and a fair amount of brainstorming, you can surely increase your chances of making a profit with each trade you conduct.

#2. Trading On Economic News

Reading economic news is the first thing a dedicated trader should do before reading charts. It can give traders an idea of a region's economy and determine whether the prices of assets will rise or crash down. By knowing this, one can invest at the right time and in the right asset, increasing their chances of winning.

#3. Price Action

Price action teaches one to find entry points in any market or trading mode. The concept is to find visual confirmation of whether the bulls or the bears dominate the market. Not to forget, it's always recommended to look for entry points close to the support and resistance levels.

#4. Personal Trading Instructor

When someone invests diligently on a trading platform, they obviously wish to gain the maximum profit possible. But, none can be a master in a day. There needs to be substantial planning, experience, and patience. As trading instructors are educated and experienced market investors, they are aware of tips and tricks that can increase your chances of pocketing a profit.

Due to their connections, most instructors can help you get inside news of a company or organization. This can help plan a better strategy of when, where, and how much to invest.

Best Indicators On Olymp Trade

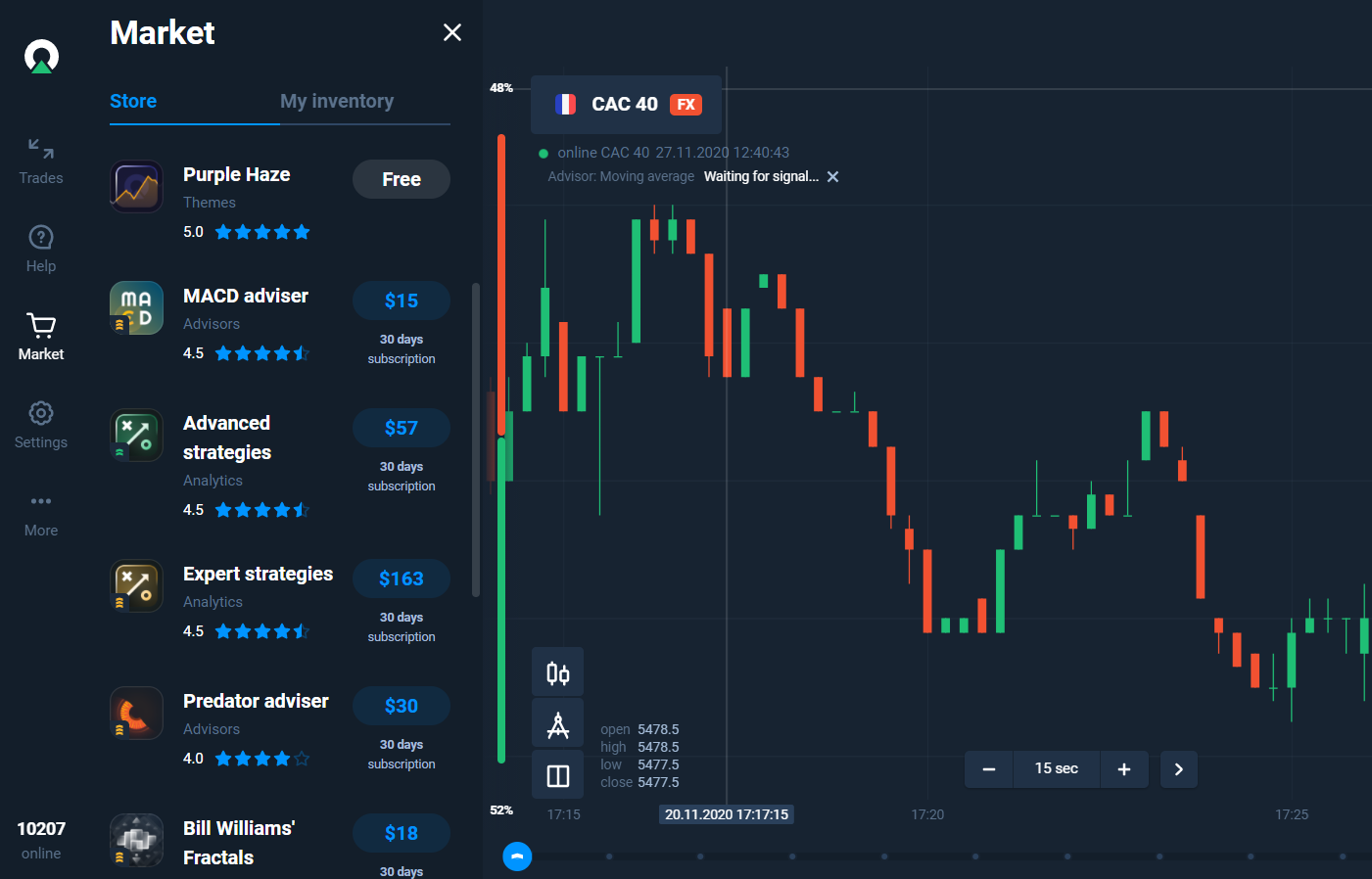

Statistical tools used to measure current conditions and forecast financial or economic trends are known as indicators on online trading platforms. Many traders on Olymp Trade use a few popular indicators, such as:

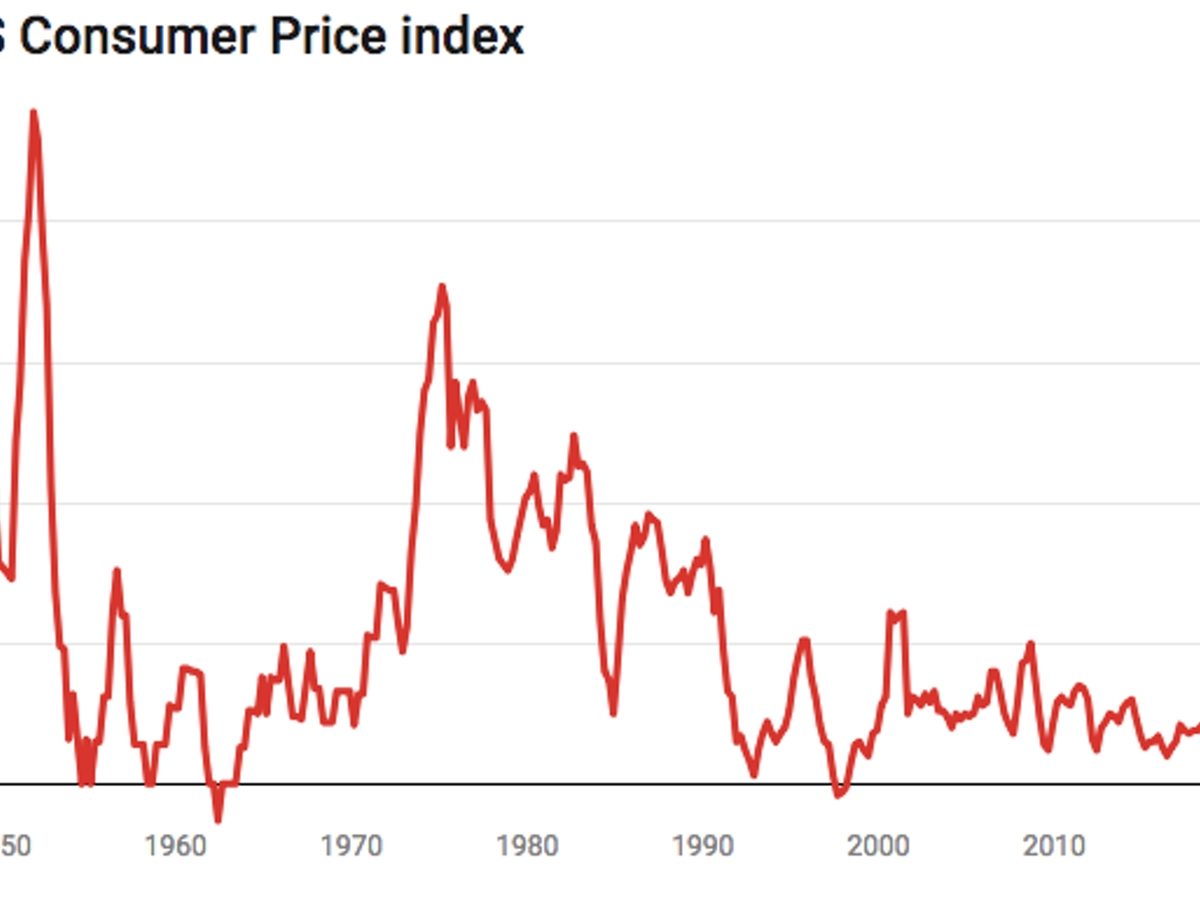

#1. Consumer Price Index (CPI)

CPI is an economic indicator, which is the weighted price average of a basket of consumer goods and services. Remember, any CPI changes are instrumental in identifying periods of inflation or deflation.

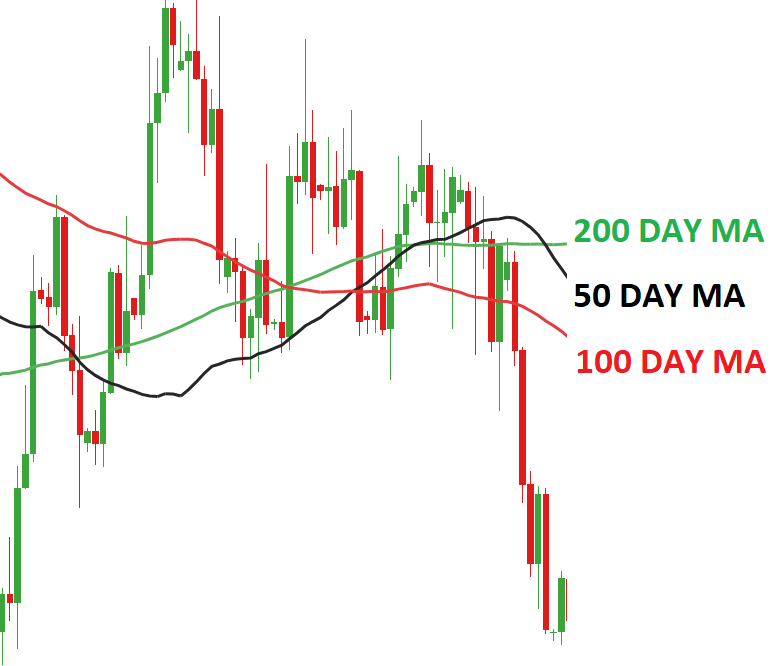

#2. Moving Average (MA)

This indicator is used to identify the general direction or trend of a given stock. To add on, the MA indicator smoothens historical price data by generating a constantly updated average price. If MA moves in a negative direction, that’s a bearish sign for the stock.

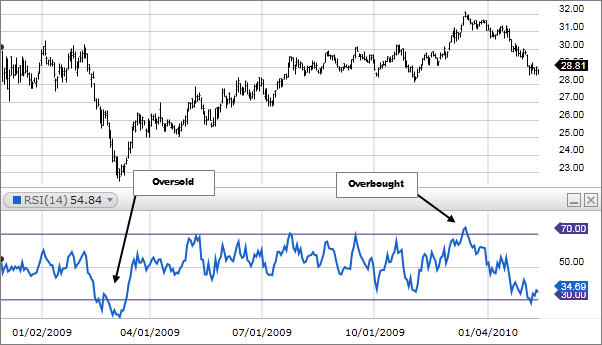

#3. Relative Strength Index (RSI)

Developed by J. Welles Wilder, this indicator compares the magnitude of recent gains and losses over a specified period. In the RSI indicator, a reading below 30 may indicate oversold conditions, and readings over 70 often signal overbought conditions.

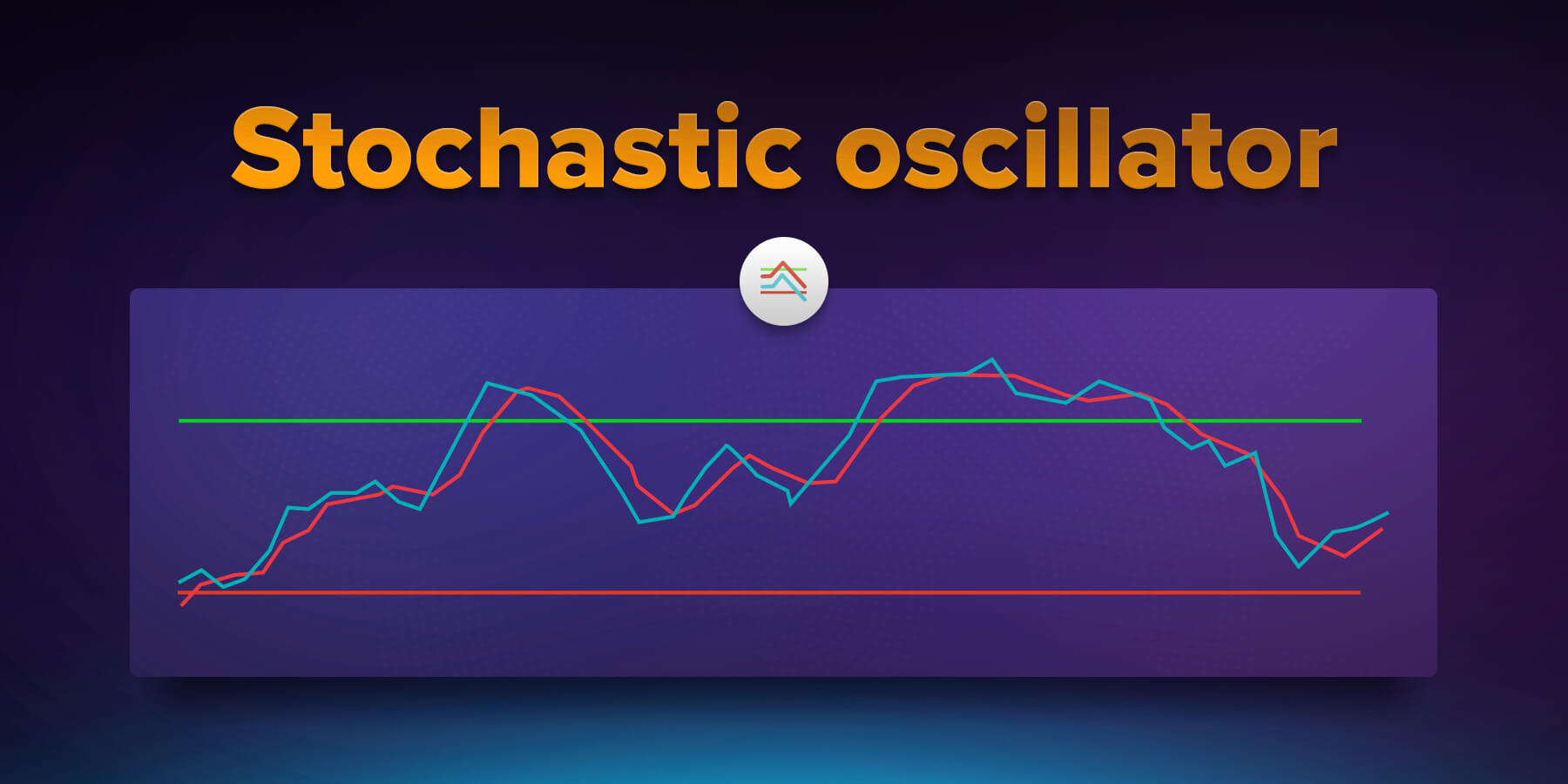

#4. Stochastic Oscillator (SO)

The precision factor of this indicator measures the current level of buying and selling pressure. The indicator ranges from 0 to 100, with readings above 80 representing overbought market conditions and below 20 representing oversold market conditions. SO also measures the rate of change in the movement, which is valuable to track when an asset reverses its trends.

Tips And Tricks For Trading On Olymp Trade

By combing the vast range of trading strategies offered by Olymp Trade with these tips and tricks, you are guaranteed a smoother and more profitable trading experience on the platform:

What Is The Success Rate For Olymp Trade Traders?

By looking at the features of this platform, one can know that this is a stable platform with a comprehensive list of statistical, analytical, and technical features simplifying a trader's decision-making process. But, the success rate of online traders depends not only on the platform they use but also on their knowledge and manner of strategy implementation.

However, by keeping the above-discussed points in mind, one can successfully raise their success rate on OT.

Does Olymp Trade Cheat?

Regulatory bodies like FinaCom, FSCA, and VerifyMyTrade work as the licensing authorities for this trading platform. They keep a check on all the terms and conditions and see to it that there's fair and transparent trading. Therefore, Olymp Trade is a trusted platform and doesn't cheat their users by any means.