Exness Review - Is it Safe and Legit or a Scam? [2024]

Category Winners

We recommend trading with Exness, and here’s why:

Not a Fraud

Recommended

Exness is reliable, globally regulated CFD broker known for its transparent trading conditions, low trading fees a fast order execution. Exness is an ideal broker for beginner and advanced traders as well, as it provides low spreads, customizable leverage and no overnight fees on major instruments like forex, gold, crypto, and indices. Exness' unique stop-out protection reduces the risk of sudden position closures and giving you more control over your trades.

Quick Facts About Exness

- Exness Group was founded in 2008 and has multiple legal entities like Exness (UK) Ltd and Exness (CY) Ltd, with headquarters in Cyprus and the United Kingdom.

- Exness serves over 800,000 active traders globally and has a workforce of 2,400+ employees across 7 global offices.

- The broker has achieved a monthly trading volume of $4.5 trillion as of August 2023.

- 95% of withdrawals are processed instantly, usually in under a minute.

- Available in 180 countries, including South Africa, India, Brazil, Argentina, and Indonesia, but it is not available in the USA, Canada, Malaysia, Singapore, or the European Economic Area (EEA).

- The broker supports a global network of over 119,000 affiliates that have earned over $1 billion in affiliate commissions so far.

- Exness offers unlimited leverage, very low trading fees (starting from 0 pip), a free $10.000 demo account, and a $1 minimum deposit requirement.

Exness Key Features: What Makes the Broker Unique?

1. Ultra-fast Execution

Exness is a reliable trading platform because it can perform millisecond-level execution speeds, which is critical for CFD traders who require rapid market entry and exit strategy and take advantage of small price movement. Many traders from other low-performing brokers suffer from slippage and delays, but Exness is able to minimize this by offering more favorable trading conditions for its clients.

2. Customizable Leverage

Exness offers customizable leverage of up to 1:unlimited (depending on the region and asset), allowing traders more flexibility to match their strategy based on their risk profile. While most brokers only offer around 1:500-1:1000, Exness' very high leverage appeals to more traders due to its flexibility. However, high leverage carries significant risk that is not ideal for traders with a low-risk tolerance. Although Exness has risk management tools like negative balance protection, inexperienced traders can still get tempted to set the leverage too high, potentially magnifying their losses.

3. Stop-out and Risk Management Protections

Exness features 0% stop-out to prevent further losses when your margin falls to 0% and stop-out protection to minimize the automatic closure of positions during a highly volatile market. This, combined with negative balance protection and limit slippage rule for pending orders, helps mitigate significant trading losses, ensuring you won’t lose more money than your initial deposit.

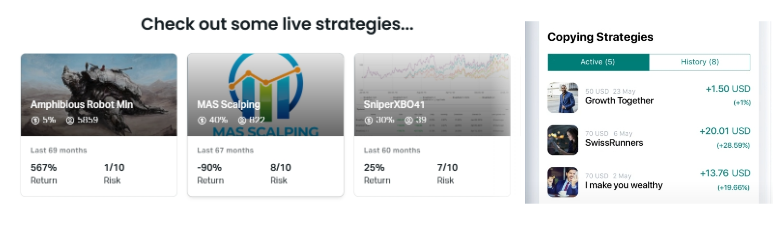

4. Social Trading

Social trading is a feature that makes Exness suitable for beginners because it allows users to follow and copy the trading strategies of experienced traders. To enable the feature:

- Hold at least $600 on your account to become eligible.

- Go to your “Personal Area”.

- On the dashboard, go to “Social Trading”.

- Discover strategies by checking statistics before you decide which strategies to copy.

NOT

SCAM

Is Exness a Scam?

Exness is not a scam, as it operates under a robust regulatory framework and is recognized globally, holding various awards and trust among CFD traders.

As a member of multiple regulatory authorities, Exness ensures a secure trading environment and client protection, safeguarding your account from fraudulent practices common among unregulated brokers.

Here are 4 reasons why we trust Exness:

1. Strong Global Regulation by Top-Tier Financial Authorities

Exness is headquartered in Limassol, Cyprus, and regulated by CySEC. It also maintains offices in South Africa, Seychelles, Curaçao, Kenya, the British Virgin Islands, and the United Kingdom, all registered with top-tier financial authorities.

Exness holds licenses from:

- Financial Sector Conduct Authority (FSCA) in South Africa.

- Cyprus Securities and Exchange Commission (CySEC) in Cyprus.

- Financial Conduct Authority (FCA) in the UK.

- Financial Services Authority (FSA) in Seychelles.

- Central Bank of Curaçao and Sint Maarten (CBCS) in Curaçao.

- Financial Services Commission (FSC) in the British Virgin Islands.

- Financial Services Commission (FSC) in Mauritius.

- Capital Markets Authority (CMA) in Kenya.

- Jordan Securities Commission (JSC) in Jordan

Exness is also a member of the International Financial Commission, a third-party authority that serves as a mediator between the broker and its clients during financial disputes. These regulatory frameworks encouraged the broker to provide additional layers of investor protection, like compensation funds, instant withdrawals, stop-out protection, and client funds segregation. So your money is far from getting scammed because of online trading authorities that help resolve your disputes or punish Exness for potential shady operations.

2. Reliable Instant Withdrawals & Secure Fund Access

Exness is one of the first brokers to offer instant withdrawals across all payment methods and account types, with 95% of requests processed within 1 minute. Unlike scam brokers that delay payouts, Exness ensures you receive your funds promptly. Instant withdrawals provide peace of mind by reducing the risk of fund loss and eliminating unnecessary processing delays, giving you immediate access to your money in your bank account or wallet.

3. Trusted by 800,000+ Traders with Global Awards and Recognition

Exness is a globally recognized and reputable CFD broker, trusted by over 800,000 active traders across 180+ countries, with a strong presence in South Africa, Latin America, and South Asia. In 2024, Exness won “Best Trading Conditions” at the UF Awards LATAM, “Double Honors” at FMAS 2024, and “Best Multi-Asset Broker” at the Brokersview 2024 Awards.

Exness receives positive reviews for its tight spreads, high leverage, instant withdrawals, and fast order executions.

Here are Exness ratings across major platforms:

- 4.8/5 Trustscore on Trustpilot (86% rated it as 5 stars)

- 4.3/5 on Google Play Store (150k+ reviews)

- 4.2/5 on the Apple App Store

4. Strategic Partnerships and Corporate Responsibility

Exness is dedicated to maintaining its reputation as a trustworthy, reliable broker and strengthening its relationship with its clients through affiliations and social activities. Exness social relationships and company programs include:

- Official regional partner of Spanish La Liga in Latin America from 2023-2025.

- Official Sponsor of Cyprus Wakesurf Championship 2023.

- Official Sponsor of Forex Expo Dubai 2023.

- Exness Team Pro - selection of highly-skilled trader influencers from Asia, the Middle East, Latin America, and Sub-Saharan Africa.

- Exness Partnership Program - over 119 000 affiliates.

- Exness Corporate Social Responsibility (CSR) - education, environment, and drone development.

Is Exness legal?

Yes, Exness is legal in most countries across Central America, South America, South Asia, Southeast Asia, Sub-Saharan Africa, the Pacific region, and the Middle East. This includes countries like South Africa, Indonesia, Brazil, Mexico, Argentina, and Colombia, where Exness operates under strong regulatory oversight.

In South Africa, Exness is regulated by the Financial Sector Conduct Authority (FSCA) and holds an Over-the-Counter Derivative Provider (ODP) license. This means that South African traders are protected under local financial laws, ensuring a high level of transparency and security for their funds.

However, Exness is not legal in regions such as the USA, Canada, the European Economic Area (EEA), and some parts of Asia due to local regulatory restrictions. For instance, Indian traders face some legal uncertainty because Exness is not regulated by SEBI or the RBI, but the broker is still overseen by global regulatory bodies like the FCA and CySEC.

Trading Platform

Exness offers a range of powerful trading platforms catering to the needs of beginner and pro traders. Its platforms make it a preferred choice for CFD traders due to advanced features, seamless trading, and fast execution speeds. Here’s an overview of Exness platforms and their advantages over other CFD brokers:

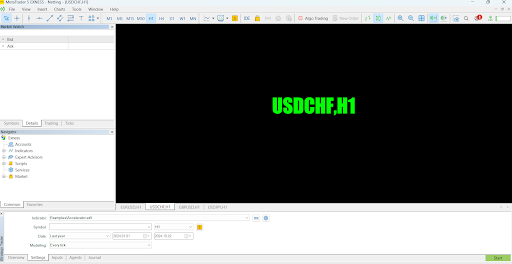

1. MetaTrader 4 (MT4) and MetaTrader 5 (MT5)

Exness supports MT4 and MT5, which are popular platforms used for CFD trading, which makes it easier for you to connect with the trading community for insights, support, and valuable resources like compatible third-party tools and add-ons.

- MT4: Available on mobile and desktop. The software works great for forex trading since it features 3 trading charts, 24 analytical tools, 30 customizable indicators, backtesting capabilities, and access to Expert Advisors (EAs) for automated trading.

- MT5: More advanced than MT4 and is also available on mobile and desktop. The software is more ideal for a wider range of assets (forex, stocks, indices, commodities, and crypto) because it features a full set of trader orders (buy and sell stop limits), 40 customizable indicators, and advanced analytical tools. It’s a more capable strategy tester, account manager, and automated trading than MT4.

2. Exness Terminal

The Exness Terminal is a proprietary web-based platform that features a simple interface, instant access from browsers, fast trade execution, and full integration with your Exness ecosystem because you can easily open it on your browser on any device. Compared to MT4 & MT5 it has a less complicated interface, features a one-click trading mode, can be accessed on browsers, and it uses a familiar trading chart, TradingView. So it’s a simpler alternative to MT4 & MT5 for beginners while having the essential capabilities and features.

3. Exness Trade App (Mobile Trading)

Exness Trade App is the broker’s proprietary platform on mobile phones designed to make trading more portable. The app comes with full account management and fast-trading execution features that are optimized for mobile phones. It’s ideal to have the mobile app installed on your phone so you can stay updated on the financial market news, set up price alert notifications, execute trade, manage accounts, use in-app trading calculators, and perform technical analysis.

Assets

Exness is a multi-asset broker that offers a wide range of financial instruments, providing more adaptability to various market conditions, diversification strategies for its clients, and tighter spreads. Although, Exness only deals with Contract for Differences (CFDs) on:

- Forex

- Commodities

- Stocks

- Indices

- Crypto

Fees

1. Trading Fees

Exness attracts cost-conscious clients because it doesn’t charge trading fees on forex, commodities, stocks, indices, and crypto on all account types except Zero and Raw Spread. Additionally, Exness has tight spreads, particularly for popular instruments like EUR/USD and gold on Zero and Raw Spread account types. People seeking favorable pricing appreciate the low to no fees and tight spreads from Exness, especially if you are a frequent trader or have a limited trading budget.

2. Overnight Fees

Exness does not charge overnight fees (swap-free) on most major forex pairs, indices, and crypto, making it attractive for long-term investors. However, most commodities, stocks, minor forex pairs, and exotic forex pairs aren’t swap-free.

3. Inactivity Fees

Exness charges inactivity fees if an account is inactive for a prolonged period (12 months of inactivity). For casual or part-time traders, these fees can accumulate, making the platform less appealing compared to brokers who don’t charge such fees.

Account Opening

To open an account with Exness, just follow the steps below:

Step 1:

Visit the Exness website on your browser or install either the mobile or desktop apps.

Step 2:

Find the “Register” button.

Step 3:

Enter the necessary details (e.g. email address, personal details, password). You can also register using your Google account.

Step 4:

Find the “My Accounts” section to open a new trading account.

Step 5:

Select your trading platform (e.g. MT4 or MT5).

Step 6:

Choose your account type.

Step 7:

Enter your trading preferences if asked (e.g. Max leverage, Currency, Account nickname, trading account password).

If you experience any issues with accessing your account, we have a detailed guide on how to fix common Exness login errors.

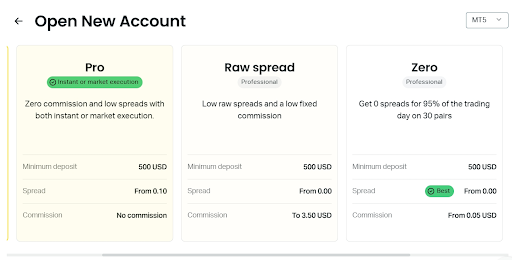

Account Types

Exness offers Standard and Professional account types, featuring 5 live accounts that are also available for Islamic accounts, and 4 demo accounts with $10,000 worth of virtual money. Here’s an overview of each account type on Exness:

1. Standard

- Minimum initial deposit: $1 (can vary on different payment methods)

- Spread: From 0.2 pips

- Commission: No

- Demo account: Yes

2. Standard Cent

- Minimum initial deposit: $1

- Spread: From 0.3 pips

- Commission: No

- Demo account: No

3. Pro

- Minimum initial deposit: $200

- Spread: From 0.1 pips

- Commission: No

- Demo account: Yes

4. Raw Spread

- Minimum initial deposit: $200

- Spread: From 0.0 pips

- Commission: Up to $3.50 per side per lot

- Demo account: Yes

5. Zero

- Minimum initial deposit: $200

- Spread: From 0.0 pips

- Commission: From $0.05 per side per lot

- Demo account: Yes

Deposit and Withdrawal

Exness provides a wide range of deposit and withdrawal methods from bank cards, cryptos, UPI, and e-payment systems that feature instant withdrawal options. Deposit and withdrawals on Exness appear to attract clients because of its instant withdrawal option, low minimum deposit requirements, and zero fees.

1. Instant Withdrawals

Exness is among the first brokers to offer instant withdrawal options for the majority of payment methods. The broker claims that most withdrawal requests are processed in less than 1 minute, ensuring that traders can immediately access their funds without delays. This is not a common feature in most brokers, that takes more than 1 day to process a request.

2. No Transfer Fees

Exness does not charge deposit and withdrawal fees, providing you with more affordable and convenient trading experience. Keep in mind that some payment methods may have their own charges, and although Exness may disclose the fees to you, it's still best to check it on your chosen bank or e-payment system.

3. Low Minimum Deposit

The minimum deposit is different on Standard and Professional accounts, and the amount can vary on some payment methods as well. But generally, the minimum deposit amount on Standard and Standard Cent accounts is $10, while the minimum deposit amount on Pro, Raw Spread, and Zero accounts starts from $200.

On withdrawals, use the same payment method you used during deposit. Although withdrawals don't mention a specific minimum amount required, it’s best to check the daily withdrawal limits for each payment method before entering the amount you want to withdraw to avoid issues.

Category Winners

Final Verdict: Recommended

We recommend trading on Exness due to its strong regulatory compliance, global presence, and recognition in the CFD market. Exness stands out with a user-friendly platform, instant withdrawals, competitive trading conditions, ultra-fast execution, 1:unlimuted leverage, and industry-standard risk management tools. These features make Exness a compelling choice for traders of all risk levels, offering flexibility to maximize profits while minimizing trading risks.

FAQ

Yes, Exness is regulated by several reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC).

Traders with Exness can choose between MetaTrader 4 (MT4), MetaTrader 5 (MT5), and the Exness Trader mobile app, available for both iOS and Android devices.

Exness offers 24/7 customer support via live chat, email, and phone. The support team assists with everything from account issues to technical trading questions. They also provide educational resources and tools like webinars and market analysis.

Yes, Exness offers trading in various cryptocurrencies, including Bitcoin, Ethereum, and Ripple. Cryptocurrency trading is available as CFDs, allowing traders to speculate on price movements without owning the digital assets.

Yes, Exness provides a free demo account on both MT4 and MT5, allowing traders to practice and test strategies under real-market conditions without risking actual funds.