Exness Deposit: Limits, Methods, Fees and Common Problems

Exness provides a straightforward and secure deposit process, ensuring trader convenience and accessibility with a low minimum deposit suitable for all levels. Exness offers secure payment options and strict regulatory oversight through licenses from the FCA and CySEC. Most deposits are processed instantly, with no hidden fees, minimizing costs and avoiding trading disruptions.

This guide explains Exness deposit fees, processing times, limits, transfer methods, and key policies. Read on to discover affordable, fast, and safe deposit options, plus tips for protecting your funds.

How to Deposit Funds on Exness?

Deposit fund request on Exness prioritizes safety, so you have to complete your profile information and verify your email address and contact information first. Although the deposit process on Exness takes more steps than other brokers, the thorough steps are way safer, giving you peace of mind.

Follow the simplified steps on how to deposit your money properly:

Step 1:

To deposit, complete your profile information first by going to Profile Settings.

Step 2:

Verify your account by confirming your phone number and email, as well as entering personal details and residential address.

Step 3:

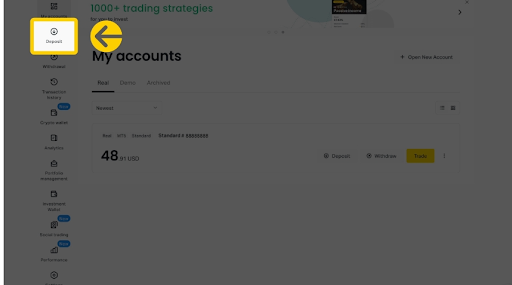

Once your account is verified, go to your Personal Area and click on the Deposit tab on the menu found on the left of your screen.

Step 4:

Select your preferred payment method.

Step 5:

Enter the required details of your chosen payment method. This varies across different payment methods. Bank transfers, for example, usually require an account number, while crypto transfers require a wallet address.

Step 6:

Enter your desired amount.

Step 7:

Click Continue.

Step 8:

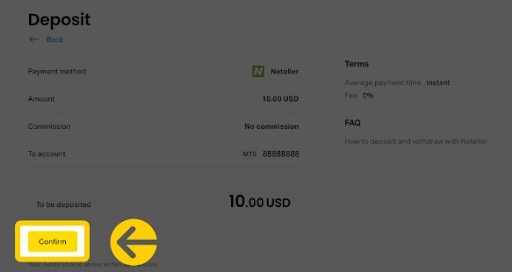

Check if all the details are correct and click Confirm.

Step 9:

Exness will redirect you to your payments’ gateway page. This step is usually straightforward and will only take a few minutes.

Step 10:

Once you’re done, check if your deposit request has been successfully processed. Note that the time frame for each payment method varies. To know when will your funds appear on your account, you can check the processing times displayed for each method on the Deposit Tab.

Deposit Methods

The deposit methods available on Exness are fewer than other brokers since the company aims to offer safe, trusted, and reliable payment methods to its users. Nonetheless, Exness still has you covered for offering widely used deposit methods. This includes your local banks, cryptocurrencies, e-payments systems, and debit/credit cards.

Here’s a list of popular deposit methods on Exness:

Cryptocurrencies

- Binance Pay

- Tether (USDT TRC20)

- USD Coin (USDC ERC20)

- Bitcoin

Electronic Payment

- Skrill

- Neteller

- Capitec Pay

- Ozow

- Perfect Money

- SticPay

- UPI

Banks

- Internet Banking

- Local Banks

- Bank Cards

Minimum Deposit

The minimum deposit at Exness is $10 in most cases, but it depends on account type and regional guidelines. Most regions maintain a consistent minimum deposit, except for Pro accounts and above. For example, in South Africa and Brazil, Standard accounts require a $10 minimum deposit, while Pro accounts and higher have a $200 minimum deposit across all payment methods. In India, the minimum deposit varies more widely: bank transfers range from $50 to $1000, and UPI payments require deposits between $150 and $300.

Here are the common minimum deposit requirements by account type:

Account Types | Minimum Deposit in USD |

|---|---|

Standard | $10 |

Standard Cent | $10 |

Pro | $200 |

Raw Spread | $200 |

Zero Account | $200 |

Deposit Limits

The maximum deposit limits on Exness vary greatly on different payment methods. E-wallets usually have lower deposit limits, ranging from $1,000-10,000. However, banks and most e-payment systems have higher deposit limits around 10,000-$50,000. The highest deposit limits are usually from Skrill, Perfect Money, Bitcoin, and altcoins, around $100,000-$10,000,000.

To understand the specific deposit limits, here’s a list of popular deposit methods and their limit amounts:

Deposit Methods | Deposit Limits in USD |

|---|---|

Internet Banking (South Africa) | $25,000 |

Online Bank (India) | $2,000 |

Bank Transfers (India) | $5,000 |

BCA Internet Banking (Indonesia) | $9,500 |

Boleto Bancário (Brazil) | $2,500 |

Online Bank Transfers (Philippines) | $16,000 |

Bank Cards | $10,000 |

UPI (India) | $1,000 |

GCash | $500 |

Skrill | $100,000 |

Neteller | $50,000 |

Perfect Money | $100,000 |

SticPay | $10,000 |

Bitcoin | $10,000,000 |

USDT TRC20 | $10,000,000 |

Binance Pay | $20,000 |

Deposit Fees

Exness does not charge deposit fees on any payment systems, but we suggest you check if your chosen payment system has processing fees. If your deposit method is in a different currency than your Quotex account, conversion fees may also apply, so keep this in mind.

Deposit Proof: Can I Trust Exness with My Money?

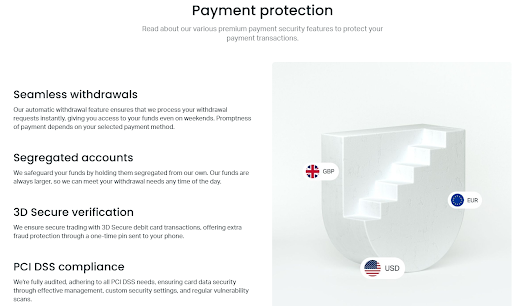

Yes, you can trust Exness with your money because it is regulated by top-tier regulatory authorities, audited by third-party financial firms, and features instant transfers. Exness is a member of CySEC, IFC, FCA, FSA, FSCA, CBCS, FSC, CMA, and The Financial Commission. This means it has client protection, investor compensation, and risk management schemes like negative balance protection and segregated client funds.

Deposit transactions are data encrypted and the company security protocols designed to protect cardholder data meets global standards. So you will barely experience any types of complications during deposit requests.

Common Deposit Problems with Exness

The common deposit problems on Exness are minor and are commonly caused by network failures, temporary maintenance, entered wrong details, or overload in the server.

Delayed Deposit Processing Time

Delayed deposit processing time is a common deposit problem you will encounter in Quotex and is usually caused by high transaction volume at the time you request the deposit. This might also occur if either Exness or your payment method encounter technical issues or undergo site maintenance. Delays can take 15-30 minutes, so we suggest you wait.

On the Personal Area’s Deposit tab, Exness provides estimated processing time on each available payment method, including the maximum time frame. So we suggest you examine which payment method works for you depending on the expected processing times. Exness also notifies you when a payment option temporarily becomes unavailable. So make sure you are aware of this as your chosen bank might be undergoing maintenance or having technical issues the time your request is being processed, hence the delays.

Deposit Processing Error

Errors during deposit processes or requests can occur for multiple reasons, like overload in the server caused by high transaction volume, temporary system maintenance, wrong transaction details, or suspicious activities.

To avoid this inconvenience, make sure you enter the right transaction details. Requesting withdrawals and deposit transfers without making any trades can get your payment method suspended as well. That’s why your request won’t go through. You would have to add another payment method if this happens.

So you won't get suspended, do not spam requests if you keep getting errors and check the reason for the error before trying again. Double check right the account details or whether the payment method or Exness itself is under maintenance or encountering technical issues. Try refreshing the page or clear the cache as this can only be caused by high-volume transactions. Also check if you exceeded the deposit limit of your payment choice.

Conclusion

Exness has strong international regulations, and it’s well recognized globally, so the deposit process is safe. The broker features instant processing time, so once you have completed account verification, the deposit process should be fast and easy. This feature will give you peace of mind, knowing that your money will appear on your account within minutes. Withdrawing money from your Exness account happens instantly, so with this broker, you have full control of your money.