Exness Withdrawal: Limits, Methods, Fees and Common Problems

Exness ensures a seamless withdrawal process, allowing traders to access funds instantly and reduce risks of delays. With client funds securely segregated from operational funds, Exness guarantees withdrawal requests are fulfilled promptly, with 95% completed in less than a minute. Licensed by the FCA and CySEC, Exness provides trusted oversight for secure transactions and uninterrupted access to your funds.

This guide covers Exness withdrawal fees, available methods, processing times, and minimum and maximum amounts. Read on to discover fast, safe, and cost-effective withdrawal options and learn why Exness is a trusted choice for traders.

How to Withdraw Your Money on Exness?

Withdrawing your money on Exness is seamless once you have completed your KYC and profile information.

To withdraw your money on Exness, follow the steps below:

Step 1:

Go to Exness Personal Area.

Step 2:

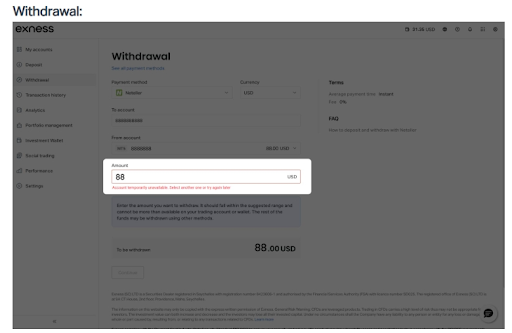

Click on the “Withdrawal” button on the menu tab located on the left side of the screen.

Step 3:

Select your preferred withdrawal option. To avoid complications, we suggest that you choose the same payment method you used when depositing. This is a common practice from most regulated brokers to ensure that the profited money only goes to the account of the user who deposited it.

Step 4:

Fill out the necessary details when asked and click “Continue”.

Step 5:

Complete the verification code sent to your contact information and click “Submit”.

Step 6:

Double check if all the account details are correct and click “Confirm”.

Step 7:

Exness will then redirect you to the payment method’s site.

Step 8:

Follow the steps there to complete the transaction.

Step 9:

Once done, you can check the details and the status of your request under “Transaction History” on your Exness Personal Area.

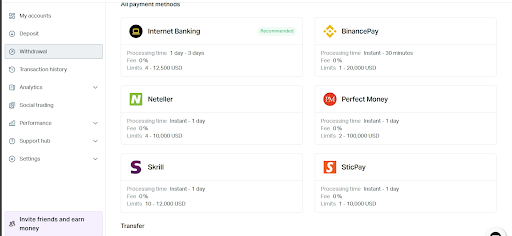

Withdrawal Methods

Exness offers a streamlined selection of withdrawal methods that vary by country, including widely-used options like local banks, leading cryptocurrencies, and major e-payment systems. Additionally, you can transfer funds between Exness accounts, ensuring you have sufficient choices for convenient withdrawals.

Below is a list of popular Exness withdrawal methods:

Banks

- Internet Banking

- Virtual Banks

- Domestic Banks

- Bank Cards

- Over-the-counters

Electronic Payment

- Skrill

- Perfect Money

- Neteller

- SticPay

- GCash

- Paymaya

- Astropay

Cryptocurrencies

- Binance Pay

- Bitcoin

- Tether (USDT TRC20)

- USD Coin (USDC ERC20)

Minimum Withdrawal

The minimum withdrawals on Exness ranges from $0-$10 (or its equivalent in other currencies) on most payment methods except for your local banks. You can check this by going to the “Withdrawal” page on your Personal Area.

Here are the minimum withdrawal amounts of popular withdrawal methods on Exness:

Withdrawal Methods | Minimum Withdrawal in USD |

|---|---|

Bitcoin | $200 |

Binance Pay | $1 |

Between Your Accounts | $1 |

Internet Banking (South Africa) | $4 |

Internet Banking (Indonesia) | $10 |

Online Bank (India & Philippines) | $50 |

Bank Transfer Direct (India) | $1,000 |

Bank Transfer (Brazil & Argentina) | $10 |

Skrill | $10 |

Perfect Money | $2 |

Neteller | $4 |

UPI Scan & Pay (India) | $150 |

SticPay | $1 |

Withdrawal Time

Exness claims that the withdrawal time takes less than 1 minute 95% of the time because the broker processes your withdrawal request immediately after you confirm it. However, the timeframe of the whole process can vary depending on your payment method, so expect that it may take up to 24 hours before it reaches your payment method’s account, especially on e-payment systems like Skrill, Neteller, and Perfect Money. In some cases, it can even take 1-30 business days, especially on banks.

Usually, cryptocurrencies like Bitcoin and Binance Pay have the fastest withdrawal time, only lasting up to 30-60 minutes. USDT and USDC can even take up to 15 minutes only. Some e-wallets, like PayMaya, have an expected timeframe of 1 hour as well.

Withdrawal Limits

Exness withdrawal limits vary on each payment method, which is disclosed on the “Withdrawal” tab before choosing your preferred option. Your location can factor your withdrawal limits as well, especially using banks. Although most global and decentralized payment methods, like Bitcoin can have the same withdrawal limits regardless of your location.

Here are the withdrawal limit of popular withdrawal methods on Exness:

Withdrawal Methods | Withdrawal Limits in USD |

|---|---|

Bitcoin | $10,000,000 |

Binance Pay | $20,000 |

Internet Banking (South Africa) | $12,500 |

Internet Banking (Indonesia) | $6,000 |

Online Bank Transfer (Philippines) | $2,450 |

Online Bank (India) | $2,000 |

Bank Transfer (India) | $5,000 |

Bank Transfer (Brazil & Argentina) | $10,000 |

Skrill | $12,000 |

Perfect Money | $100,000 |

Neteller | $10,000 |

UPI QR, Scan, & Pay (India) | $1,000 |

SticPay | $10,000 |

Withdrawal Fees

Withdrawal fees on all withdrawal methods on Exness are 100% free, but certain options may charge you for any transfer fees on their end. To check for external withdrawal fees from certain methods, ask them before proceeding. You can also go to the “Withdrawal” tab on your Exness Personal Area, then click on the available option that you want to check for external fees.

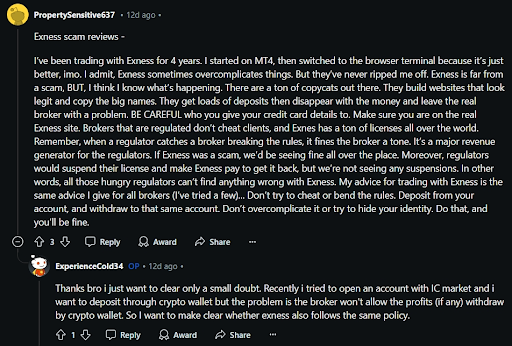

Proof: Does Exness Really Pay?

Yes, Exness really pays you without complications because of its solid regulatory framework and insurance policy, so they are less likely to block your account, hold your money, or take your money for no reason. The company is well regulated by multiple global entities like CySEC and FCA. Unlike shady and unregulated brokers, Exness can’t manipulate their policies or client agreements, with the aim to scam you and get away with it.

To give you a peace of mind, here are a few testimonials from other users showing that Exness really pays you:

Common Withdrawal Problems

Withdrawal Request Transaction Failed

Failed withdrawal requests on Exness can be caused by the following:

You can check the error code of the failed withdrawal request on the “Transaction History” tab in your Personal Area. We suggest you avoid making further attempts after the first transaction failure to avoid getting locked out or blocked. Instead, find out what the error code means on Exness Help Center.

Account Unavailable for Withdrawal Requests

If you encounter this error, this means the platform is having a technical problem with processing your money transfer. This is a minor glitch and you just have to refresh the page, and try again later. Try choosing another payment method if it fails after 2-3 attempts.

Conclusion

The fast withdrawal time, thorough verification process, and zero transaction fees demonstrates Exness has trustworthiness and credibility. The broker is financially stable and well-regulated. Which is why we suggest the trading platform for CFD traders.

Although you might encounter minor setbacks, Exness remains transparent. The “Withdrawal” page immediately declares estimated processing time frame and potential fees for each method to set up your expectations. This allows you to deliberately choose the right transfer method that effectively and conveniently works for you. You don’t also have to worry about sudden account suspension or disappearing of withdrawn funds for no reason because the company is subject to strict regulations. Exness is being monitored by multiple regulatory bodies, so your funds are insured, well protected, and segregated from operation funds.

As long as you complete the account verification, choose reliable payment methods, correctly request withdrawals, and you don’t violate the company policy, you won't encounter significant withdrawal setbacks with Exness.